Everyday investing

What would a portfolio of your most-used companies look like? In this blog, Investment Analyst James Carr explores the pros and cons of investing in everyday essentials.

One of the most interesting and thought-provoking parts of our job often involves meeting fund managers who will, especially when meeting them for the first time, spend a great deal of time talking about the investment process and how they generate and implement ideas.

These will have varying degrees of complexity depending on the strategy, from plain vanilla equity investing in a certain sector to more complex fixed interest and currency trading to express views on macro themes and trends.

Perhaps the greatest (or at least one of the most famous) investors, Warren Buffett, vowed to never invest in a company that he didn’t understand. This has often led him to invest in very simple businesses such as food and beverage companies, insurance and, only more recently, technology companies such as Amazon and Apple.

Many other fund managers employ a similar strategy with a focus on brands and items that we all use on a day-to-day basis, whether it be fuel for the car or deodorant from the supermarket. The idea behind this is that in times of economic struggle consumers will still purchase these goods, making the companies more defensive and resilient. Taking this a step further, could we create a portfolio of companies or products that we all use every day? How would this perform? What risks would there be?

As a bit of a proxy for how a portfolio using this approach could look, I will use some of the companies I have interacted with or purchased from in the last month or so. Admittedly, this is an imperfect science as everyone has their favourite brands and shops, and not all companies are publicly traded on an exchange, but it should give us a flavour.

Starting with online banking at Halifax, (Google phone, Vodafone network paid to Carphone Warehouse and all public!) there are themes for products that I purchase every month. The first couple are some of the more obvious ones, fuel from Tesco and shopping from Ocado and this week, with it being close to Christmas, Amazon has appeared a few more times than usual! Rather than bore you with this rather dull run through of my spending habits, I have instead created a portfolio of the 30 companies I used the most over the last few months along with the sector that they reside in.

As expected, there is a huge exposure to consumer staples and consumer discretionary companies, with a small mix of technology, financial services and communications. This is hugely different to the Global MSCI World Benchmark as there are several sectors completely omitted, from healthcare to industrials, and large underweights in technology and financials.

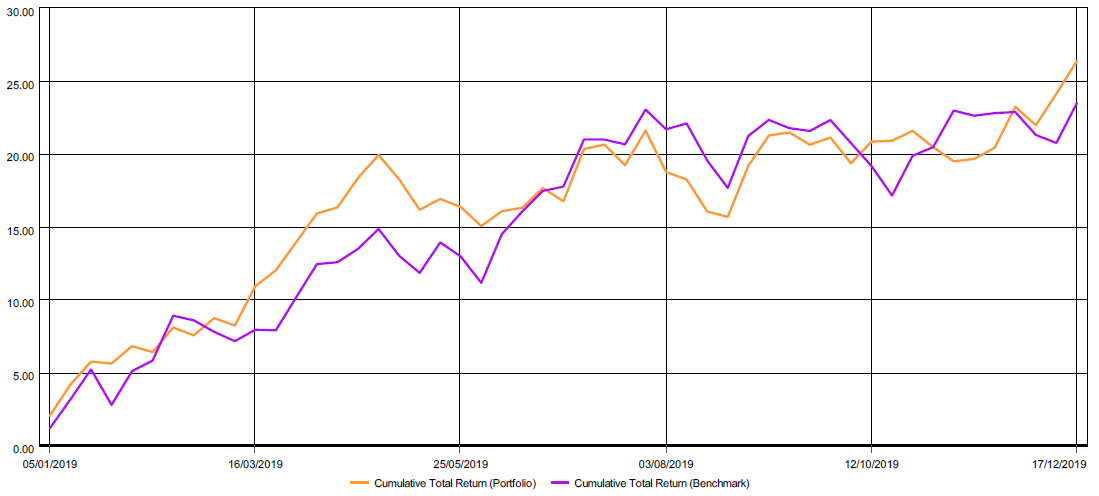

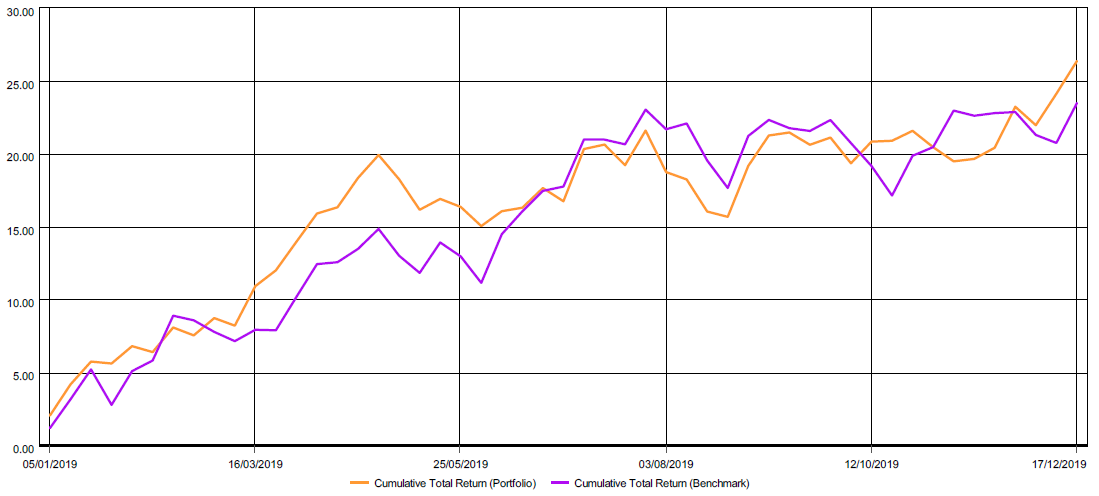

If we equal weighted this portfolio and back tested for performance against the MSCI World benchmark we can see from chart one below that the basket of items or companies I have used has performed exceptionally well, outpacing the world index.

Chart one: hypothetical portfolio vs Global MSCI World Benchmark

Source: Thomson Reuters Eikon

Before patting myself on the back too much, it is worth highlighting some of the risks. My top performer, Pets at Home, (thanks in a small part to all the gravy bones bought for my 18-month-old Cockapoo Norman!) is now 6.7% of the portfolio, having gone up 153% this year! This is a huge degree of stock specific risk and could be influenced by a huge number of different factors, for example a weakening pound making import costs higher, company specific execution risks, Brexit complications or Norman changing his taste buds!

On a valuation basis, the portfolio trades on 40 times trailing price to earnings (p/e ratio) making it nearly twice as expensive as the World Index whilst earning a lower return for every pound invested. There is also significant risk, for example, given the small exposure to US companies, it could underperform in relative terms should US equities rally strongly. Finally, from a style point of view, it is very geared toward global growth meaning a style rotation away from this would hurt performance.

Whilst a fun and certainly interesting exercise to carry out, the most important point to take from this is that understanding the risks is vital when employing any investment strategy, alongside being aware of when it could do well, when it may underperform and what is driving this.

At Equilibrium, we are firm believers in active management of diversified portfolios to deliver the best possible returns for our clients – but only after fully assessing the risks of any asset class, stock or market.

I hope you enjoyed this blog, and from all of us on the investment team at Equilibrium, have a great Christmas and a happy new year.

The content contained in this blog represents the opinions of Equilibrium Investment Management. The commentary in this blog in no way constitutes a solicitation of investment advice. It should not be relied upon in making investment decisions and is intended solely for the entertainment of the reader.