Financial Toolkit for millennials: How you could already be boosting your pension

Employer contributions are a great way to boost your pension pot for retirement. But barely anyone is using them to their full potential. Here, Financial Planner Ben Rogers explains why it might be worth seeing what else your employer could offer you.

Saving for retirement is challenging, making you divide your income between current expenses and your pension pot which you can’t access until the age of 55. And when you look at your payslip and see all those deductions tallied up that define your take home pay, why would you want to give up more of your hard-earned cash?!

However, by doing just this you might be able to substantially boost your pension pot down the line. Let me explain…

Most people are aware that Workplace Pension rules forced eligible employers and employees to start contributing to a pension. Essentially, employees pay in 3% and your employer pays in 2% (2018/19).

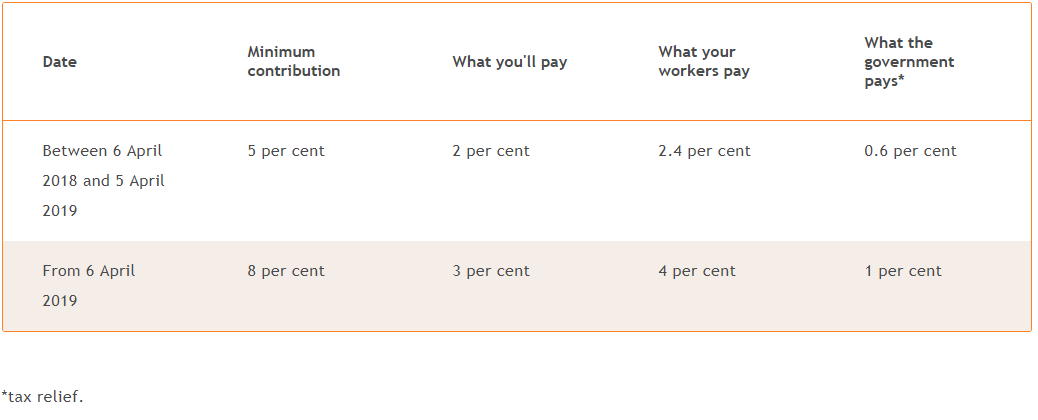

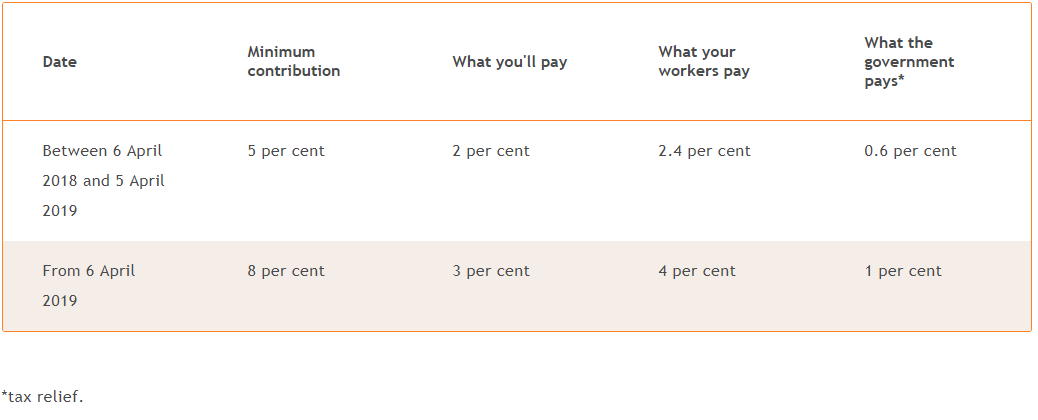

One of the main benefits of pensions is that under current tax laws you don’t pay income tax on the money you pay in. Here are the current minimum employer contribution rates (source NEST):

What many people don’t necessarily realise is that some employers will pay more into your pension pot if you increase the amount you pay in. Although it depends on your employer, this can be anywhere from 5% up to 15% of your pre-tax pay. But barely anyone is doing this! A survey by Royal London has found that 44% of employees just contribute the minimum level to their pension and only 29% contribute the maximum.

While the Workplace Pension is a starting point, you could be missing out on a great way to add to your savings for retirement.

What difference could matching employer contributions make?

To give you an idea of how important matching employer pension contributions can be, take Tom.

Tom is 30 and earns £30,000 a year. Under the workplace pension, he pays 3% of his pretax pay into his pension and employer pays in 2%. Tom’s pretax pay is £2,500 a month so this means he is paying in £75 and his employer is contributing £50. Added together, this means £125 is being contributed to Tom’s pension every month.

However, what Tom doesn’t realise is that his employer will actually match contributions of up to 10% of his pretax income (or £250). So, by contributing £175 more of his pretax pay, Tom is effectively boosting his pension contributions to £500 a month (£250 from him and £250 by his employer).

After one year of £125 being contributed to a pension every month Tom would have a £1,500 saved. However, if he was to boost his contributions and put away £500 a month this would accumulate £6000. And that’s based on contributions alone over one year.

A big decision

The example of Tom shows how a pension plan can be significantly boosted with larger contributions from both employee and employer. But Tom would need to decide if he could afford to keep contributing 10% of his pretax income to his pension, every month.

This is on top of income tax, national insurance deductions and student loan repayments. Then there is rent, bills, groceries, travel costs – and we haven’t even gotten to the fun things and short-term saving goals (like a holiday, new car or first time deposit for a house).

It can be worth looking at your monthly expenses and calculating how much you could realistically afford to put into your pension. Tom went from 3% to 10% but even by contributing slightly more than you are now could have a sizeable impact on your pension pot (and remember this is being combined with your employer’s contributions).

You may be wondering how much you’ll need to put away and this varies for everyone (depending greatly on retirement age, life expectancy and lifestyle). If you dream of retiring before 60, you need to consider the fact that you could need to live of your pension for another 30-40 years! Typically, experts suggest you’ll need an income of between half to two thirds of your pre-retirement salary to avoid an uncomfortable retirement.

The Cost of delay!

Your monthly income is valuable (indeed, you need it to live!) so you need to think carefully about how it is allocated.

But the more you can put aside now, the faster your pension pot will grow, so consider increasing your savings above the minimum rate.

Tapping into the power of time and making the most of these contributions is an important step towards your future financial freedom. To learn more about you can help enhance your pension preparations, why not sit down with an Equilibrium Financial Planner? You can arrange a no obligation, free meeting by getting in touch today.

Disclaimer: The information provided through the Equilibrium website is based on our opinion and is for general information purposes only. It is not and should not be construed as financial advice. Rates of tax, tax benefits and allowances are based on current legislation and depend on personal circumstances. These may change and are not guaranteed.