What happened in 2015?

With the help of Doc and Marty McFly, if we can get the DeLorean up to 88mph, I can take you all back to 2015. Instead of flying cars, self-tying shoelaces and hoverboards like in the hit 1989 film, real life was far from the exciting world that director, Robert Zemeckis, created. In the UK, the most notable moments were Jeremy Clarkson getting sacked from Top Gear for assaulting a producer and Facebook hitting 1 billion users.

What you might not recall from 2015 is the then Chancellor of the Exchequer, George Osbourne, set out the Pensions Freedoms Act (I’m not sure this would’ve been a compelling storyline in Back to the Future II).

Pension Freedoms allowed holders of defined contribution pensions, over the age of 55, to flexibly access their pension pot and use the funds for either a desired income in retirement or to purchase other retirement income products at their own discretion. It may not seem like it now, but at the time, this caused pretty big waves within the financial services profession. Last year alone, over 205,000 more people entered into flexi-access drawdown, which is up by 24% from the previous year. (Advised drawdowns up 12% as FCA signals retirement income probe – FTAdviser.com)

Before Osbourne announced this shake up in the pension’s world, one of the most common options for investors approaching retirement was to purchase an annuity with their pension savings.

An annuity is a contract between yourself and an annuity provider, that in exchange for some or all of your pension savings, they will provide you with a guaranteed income based on the current annuity rates offered at the time.

For example, after taking tax-free cash, if you had a £1,000,000 pension and annuity rates were 3%, you would receive an annual income of £30,000 (less income tax).

The annuity rates that providers offer is linked to Government bond yields (Gilt yields) and other factors such as your age, health, life expectancy and any additional benefits (such as adding a guaranteed period, joint life or fixed term) will also be considered in your offered rate.

As well as the Pension Freedoms Act, which offered retirees a more accommodating way to access their hard-earned money, another factor in the unpopularity of the annuity is that since the end of the global financial crisis in 2009, interest rates in the UK have been at historic lows.

But why do interest rates matter to annuities?

Interest rates play a major role in how government bonds are valued. Bond prices and interest rates have an inverse relationship to each other: if interest rates go up, bond prices typically come down and vice versa.

When the price of a bond falls, the yield increases.

Example:

You purchase a Government Bond for £100,000, paying a 2% coupon rate. You would receive £2,000 a year.

The bond price then falls to £80,000 in a year’s time, you still receive your £2,000 of interest (as agreed at outset based on the par value), the yield is now 2.5% and not the previously stated 2%.

Given that the Bank of England has increased interest rates up from 0.25% in December 2021 to 2.25% as of September 2022, many think tanks and financial institutions have suggested that they expect a further interest rate rise. (Source: Mini-budget will likely mean higher interest rates, warns Bank of England governor | Interest rates | The Guardian)

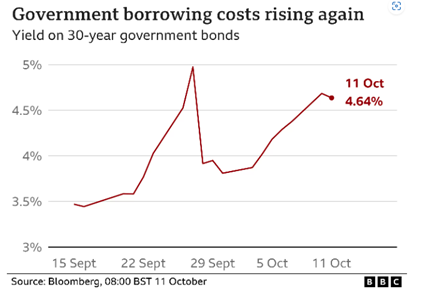

Based on this expectation, it has caused government bonds to fall in value and the 30-year yield on government bonds are now around 4.64% (as of 11 October 2022), levels which we haven’t seen since 2008. (Source: Bank of England in fresh emergency move to calm markets – BBC News)

This has prompted many to ponder whether annuities could make a miraculous return to retirees’ financial plans.

Annuities come in different shapes and sizes and usually the more added benefits onto the annuity contract, the rates reduce. For example, an escalating, joint lifetime annuity with a guarantee period of 5 years will come at a lower rate than a single life, fixed annuity for 2 years.

As with a lot of financial products, they often come with a lot of terms and jargon which can cause confusion. I have therefore provided a breakdown of common terms below.

| Annuity term | Description |

|---|---|

| Single life | Taken out in your name only and provide a monthly payment for as long as you live. When you die, the income stops and there is no capital to pass on. |

| Joint life | This provides you and your nominated beneficiary (usually a spouse or significant individual) with a monthly income until the second person (or third in some cases) passes away. If you pass away before your beneficiary, the latter will receive your pension, although usually at a reduced rate. Again, there is no remaining capital. |

| Lifetime | The annuity is guaranteed to pay for the entirety of your life. |

| Temporary / Fixed | The annuity will pay you for a set amount of time. e.g., 5 years, 10 years etc. |

| Level | You will receive the same payment from the start to the end of the contract. This means that over a long period of time, inflation could erode the real value of the payments. |

| Escalating | The income you receive from your annuity will either increase with inflation or a pre-determined amount (e.g., 4%) on an annual basis. |

| Guarantee period | Even if you pass away, the annuity will still make the regular payments for a guaranteed amount of time. |

| Enhanced / Impaired Life | If you are in poorer health, the annuity provider will offer you a better rate than standard annuities. It is typically available for people whose life expectancy is less than five years. |

| Immediate care needs / long-term care | This can be used when a loved one goes into care to cover some or all the costs of care home fees. If paid directly to the care home, it is classed as a tax-free payment. |

Is an annuity right for you?

I hope by now you have a grasp on what an annuity is and how they work, but how do you know if this is the best retirement option for you?

First, let’s consider the benefits of purchasing an annuity:

- Certainty

You will receive a guaranteed income for life or a set period, which could be inflation linked. After you pass away, your spouse or partner could receive a proportion of the income.

- Insurance against volatility

Whatever is going on in the financial markets (such as in the current uncertain economic landscape), an annuity offers peace of mind by guaranteeing an income each month, without the emotional rollercoaster of seeing the value of your pot fluctuate.

- Longevity

There is no need to worry about outliving your pension pot, a lifetime annuity will continue to provide income until the day you die.

However, there are drawbacks:

- Lack of flexibility

As the income level is fixed throughout the annuity contract, you cannot alter the annuity payment to cover any ad hoc spending such as a luxury holiday, your child’s wedding or home renovation for example.

Typically, what we have experienced with our clients, is they spend more in their early retirement years whilst they are fit and healthy, however this tapers down in their early to mid-80s, as there is less desire to spend on such things as travel or luxury items. For those with variable changes in spending, an annuity may not be suitable.

- Less control

At Equilibrium, we consider all assets and income sources and take a holistic approach to retirement planning. As we have seen in the past few weeks, governments can alter tax rates at the drop of a hat. Having a set level of income, liable to the prevailing rates of income tax, means there is no way of replacing this retirement income with other more tax efficient sources.

- Intergenerational planning

When you purchase an annuity, you are giving up capital value for regular income. As such, the capital cannot be passed to your spouse or provide a legacy for future generations.

A spousal benefit and/or guarantee period can be added to an annuity, but the income they receive is at a reduced amount and they still wouldn’t have access to the capital.

“Wait a minute Doc…”

From my experience, being closely involved with people making the decision to retire, there appears to be two overriding emotions – joy at finishing working life, but also a fear of the unknown.

There’s no ‘one size fits all’ approach to retirement planning and we recommend getting expert advice when considering your retirement options.

Our advisers are more than happy to have a free, no obligation chat here – our purpose is to help you live the life you want in retirement.

This blog is intended as an informative piece and does not constitute advice. If you have any further questions, please don’t hesitate to contact us on 0808 156 1176 or via the form below.