This article is taken from our spring 2021 edition of Equinox. You can view the full version here.

The conventional wisdom is that an ethical investment portfolio will underperform over the long term.

That’s because an old-fashioned ethical portfolio was based on a series of exclusions. There would often be a whole raft of sectors and companies which could not be included, leaving a much smaller pool of potential investments to select from.

The big problem with this type of investing is that “ethical” means different things to different people, and therefore it can be quite niche.

Its newer, slicker cousin is what we call ESG investing, and this is much more mainstream. This uses environmental, social and governance factors to actively reduce portfolio risk whilst also potentially enhancing returns. This means that ESG can (and, in our view, should) be built into everyone’s investment portfolio.

ESG investing uses evidence-based criteria to identify those companies that are actively having a positive impact on the world, those that are at least trying to avoid doing harm, and those that are having a negative impact.

In general terms, we believe that those companies who actively have a positive impact will also be winners for investors. Those that are doing harm will be losers and can present a big risk to portfolios. In fact, according to Morningstar, over the 10 years ending 31 December 2019, ESG-focused funds outperformed non-ESG funds over most time periods.

We believe this outperformance has been driven in part by two factors. Firstly, that ESG funds tend to have more of a focus on new technology which has been a great sector to invest in of late. Secondly, they tend to avoid stocks in things like oil or mining which have experienced many challenges.

Values and purpose

At Equilibrium, everything we do is guided by our core purpose to make people’s lives better and our values of integrity, simplicity, growth and excellence. The investment portfolios we manage are guided by the same principles. The good news is that we don’t have to compromise – we are not giving up growth by acting with integrity.

For example, we have included renewable energy stocks in our portfolios because we think they will enhance returns. The economic case and the environmental argument are pointing in the same direction.

ESG factors are also crucial in the other key part of investment management, which is managing risk. If a company’s governance is poor, then their management may not always act in accordance with the shareholder’s best interests. If they treat their staff badly, they probably won’t remain a good company for long!

Increasingly, environmental concerns are being viewed as a big risk factor for certain companies. The potential for a carbon tax will hit the worst polluters. Legislation may eventually prevent the big oil giants from actually accessing many of the reserves that they say they have on their books!

What constitutes “good” anyway?

The most difficult part of ESG investing is that there is no black and white, only shades of grey (or should that be green?).

Firstly, there is no consensus as to what constitutes “good”. Often it is extremely subjective and depends on an individual’s preferences. A company could also be considered good on “E” and bad on “G” or some other combination!

Take Tesla, a favoured stock in many “sustainable” funds. As a market leader in electric vehicles, battery and solar technology, most analysts think it scores well on environmental factors. Even this is somewhat controversial as Tesla requires a lot of metal and minerals, which ultimately come from mining. Despite the indirect emissions this brings, it is generally accepted that the positive environmental potential of Tesla’s technology outweighs this negative.

However, Tesla scores poorly for governance, with their CEO having a great deal of personal control and having a reputation for being somewhat unconventional! For example, in 2019 Elon Musk was sued by the US securities regulator after using his Twitter feed to announce that Tesla was about to be taken private. This had an instant impact on the share price, even though no deal was agreed (and Tesla remains a public company).

Whether you believe Tesla has a positive impact as a company therefore depends on which of these factors you believe is most important!

Doing our bit

No company is perfect from an ESG point of view, just as none of us as individuals are perfect.

I personally try to do my bit for the environment. My electricity comes from renewable sources and I drive an electric car (in fact in the past year I’ve barely even driven that!).

Even so, I have gas central heating and, even if I don’t often drive to the shops anymore, the deliveries come to me in a big diesel van! I remain exposed to oil and gas even though it is much less than in the past. There are second and third order effects to my personal carbon footprint.

Something similar is true in our investment portfolios. Our analysis indicates that our portfolios have lower carbon emissions and have much less exposure to controversial sectors like oil and gas (as well as mining, tobacco, and weapons) than industry benchmarks. However, just as I personally have some exposure to fossil fuels, we don’t exclude these sectors from portfolios completely.

We can’t turn off the taps on fossil fuels tomorrow as the global economy will fall apart. What we need to do is encourage companies to make the transition to cleaner energy. That includes persuading the likes of BP and Shell to stop channelling their money into finding the next oil field and to invest in renewable energy instead.

There is a big debate about whether we are better doing this by disinvestment – refusing to hold these companies at all – or by engaging with them. We think there is a happy medium. We’d like to hold less of such companies but engage with the companies we do hold to encourage the best behaviour.

Again, we think this is entirely aligned with both risk and returns factors. We are underweight oil and gas mainly because these industries will find it harder to make profits in future. Economic and ESG factors point us in the same direction.

Principles for Responsible Investment

We mainly invest via funds and therefore don’t directly select the stocks in our portfolios. We rely on fund managers to engage with companies on our behalf.

We are signatories to the United Nation’s Principles for Responsible Investment (PRI). This means we have committed that:

- We will incorporate ESG issues into investment analysis and decision-making.

- We will be active owners and incorporate ESG issues into our ownership and practices.

- We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- We will promote acceptance and implementation of the principles within the investment industry.

- We will work together with the PRI and other signatories to enhance our effectiveness in implementing the principles.

- We will report on our activities and progress towards implementing the principles.

We want the fund managers we invest with to adhere to the same principles and engage with companies to encourage best practice. We have therefore decided that we will not invest with fund management groups unless they are also signatories to the PRI from the end of this year.

When we first committed to this, we held two funds in our portfolios which were run by non-signatories. We have given these fund managers until the end of 2021 to sign up and are pleased that one of these groups has since signed up. The other has signalled their intention to do so.

The PRI assesses each signatory on an annual basis, and we monitor these reports. We are also engaging with fund managers directly on things like their voting records and making sure that they practice what they preach.

Risk, reward and impact

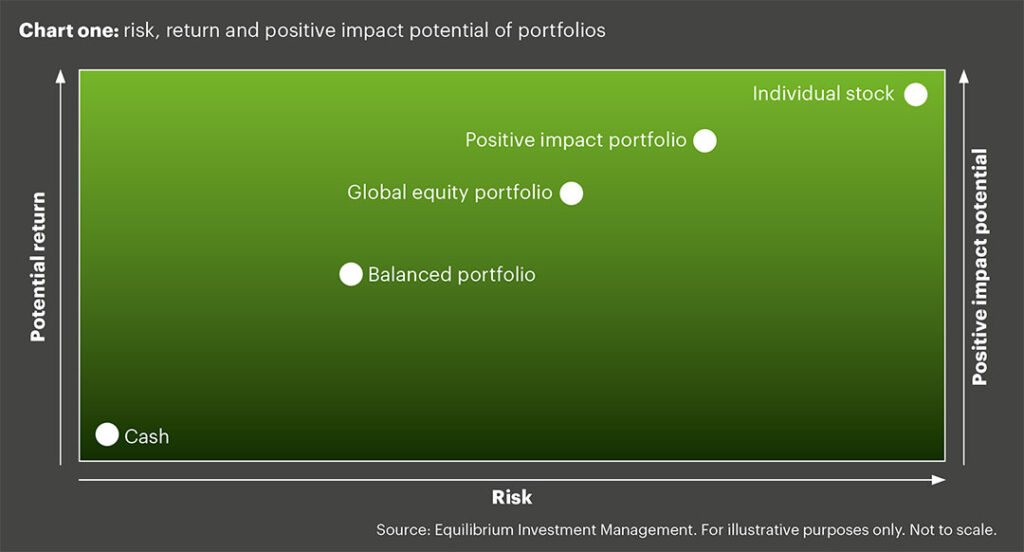

We often talk about risk and reward being correlated. “Impact” is also correlated to these factors.

For various clients we have discussed the idea of investing in assets that actively have a positive impact on the world, deliberately targeting those companies which might make the biggest positive difference (as opposed to just avoiding those that do harm).

This might include renewable energy, companies making medical advances (we’ve seen the positive impact vaccines can have!) or investing in agricultural technology (meat substitutes, vertical farming etc) and many other areas.

The biggest positive impact an investor could have (other than philanthropy) is by investing in individual companies with great products or services, but who need funding to take that next step. By nature, these companies can be small and high risk. Their technology might not work, and they could go bust.

In contrast, our core portfolios are set up to be well diversified across lots of different asset classes and sectors. This diversification reduces portfolio risk and should lead to more consistent returns, but it also dilutes the positive impact we can have in a more concentrated investment.

We are therefore launching our “Positive Impact Portfolio” which will sit alongside our core portfolios. This will be largely equity-based and will be quite concentrated in sectors with high growth and high impact potential.

As a result, it will also be a higher risk portfolio and so suitable only for those with a long time horizon.

For those who want to make more targeted investments in individual sectors, we can look at things like Enterprise Investment Schemes (EIS). These are even further up the risk scale and only suitable in selected circumstances but can also have tax benefits. We can also help clients who are looking to make a difference through charitable giving.

We think there is a world of difference between our approach and an old-fashioned ethical portfolio. Ethical is a very subjective word and means different things to different people. However, we think engaging with the companies we hold and pushing them to do better is simply good investment management.

Disclaimer: The content contained in this blog represents represents the opinions of Equilibrium Investment Management LLP (EIM) and Equilibrium Financial Planning LLP (EFP). The commentary in no way constitutes a solicitation of investment advice. It should not be relied upon in making investment decisions and is intended solely for the entertainment of the viewer. Past performance is never a guide to future performance. Investments may (will) fall as well as rise and you may not get back your original investment.’