The house always wins

Traditionally, Robin Hood took from the rich and gave to the poor.

Robinhood – the American investment platform – says their mission is to “democratize* finance for all”. We’ll discuss that later but, without a doubt, the platform and others like it have given individual American investors access to stocks in a way they’ve not had before.

We’ve discussed previously how individual investors may now be moving markets. The new trading platforms allow them to effectively gear up their trades by using options, meaning their exposure to an individual stock may be four or five times their initial cash outlay.

Often these individual traders are drawn to particular types of stock, mainly those with great stories behind them. These so- called “meme stocks” get widely shared on social media and inspire a great deal of loyalty. Tesla is a great example of a stock with a cult following, whilst others include things like cannabis stocks and Bitcoin/cryptocurrency related shares.

This gearing plus “herding” into these selected areas is having a big effect. In addition, many Americans are stuck at home having received government stimulus checks* and using the stock market for a bit of excitement! All these factors mean that some individual stocks are seeing significant movements.

Short squeeze

There’s no better example of this than the recent events surrounding a company called GameStop.

GameStop is kind of like Blockbuster but for video games. Just like we now get our movies from Netflix and Blockbuster has disappeared from our town centres, nobody goes to a high street retailer for games anymore. GameStop probably won’t be around for very much longer.

Given this challenged outlook, GameStop has been a favoured target of hedge funds. These funds have been betting on GameStop to fail, by shorting their stock.

Short selling is where you borrow some shares from an institution like a tracker fund or a pension fund. You pay them a premium, just like you’d pay interest on a loan.

Say you borrow 10 shares in a company which were £100 each when you borrowed them. You immediately sell them for £1,000 and you are then happy to see the price drop to £80 per share. This means it will only cost you £800 to buy back those 10 shares which you then return to the lender. You keep the £200 profit.

The downside to this for the short seller is the risk. If you buy a share hoping it will go up, the maximum loss is 100% but the gain is theoretically infinite – it can go up many multiples of its original price.

With short selling, the reverse is true. The maximum gain is 100% but the maximum loss is infinite. This means hedge funds have to keep tight controls over their risk, cutting their position when the losses get too big. The only way to close out a short is to buy back the shares.

This means that stocks which have high levels of “short interest” are vulnerable to a short squeeze. If the price goes up enough the short sellers have to buy back the stock, which pushes the price up even more!

This can be amplified if the buyers are using options (warning: this bit can get technical!) since there is a counterparty such as an investment bank providing those options. The bank also has to hedge their positions by buying back the stock (a gamma squeeze), ramping the price up even more sharply.

This is the way…

A group of individual investors on a Reddit messageboard decided to engineer a short squeeze/gamma squeeze in GameStop.

They were aware from regulatory filings that a number of hedge funds were heavily short the stock. The company was also tiny in American terms (just $1.2bn market cap as of 4 January) so a fairly small amount of money could make it move a long way. They felt they could force hedge funds to have to close their positions.

Co-ordinating their trades and using options to gear their positions, these traders managed to carry out their intentions of pushing GameStop shares “to the moon”!

As the shares started moving, the story gained traction and more and more investors joined the bandwagon, all egging each other on. “This is the way” began trending on social media, borrowed from the Disney+ show ‘Mandalorian’ (which we heartily recommend watching!) and used to urge followers to hold the course when things go bumpy.

Long story short – they pushed the share price up a hell of a long way and a load of hedge funds lost money. A great victory for the little guy…

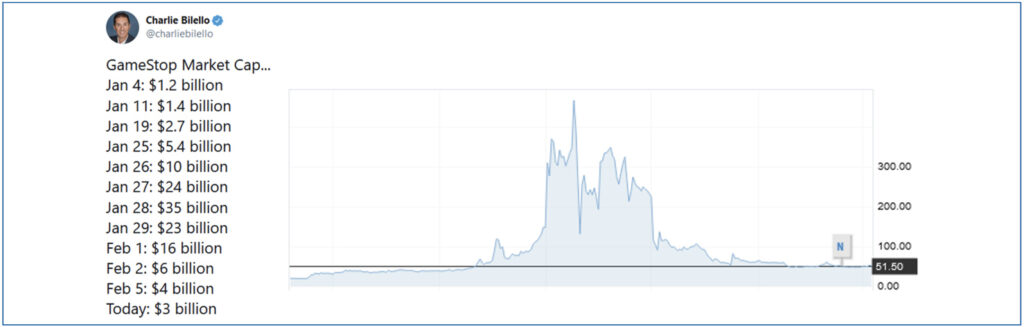

Or not. Because of course things came crashing back down to earth. The chart below shows how quickly it moved up and then fell. Another great illustration is to look at what the market capitalisation (the total value of all the shares) was at particular dates, as shown in the below tweet from American investor Charlie Bilello. It went from $1.2bn, all the way to $35bn, before crashing back down to $3bn in size, just in a couple of weeks!

Democratizing* finance?

A lot of people lost a lot of money over this, and not just one or two hedge funds.

In some ways there are similarities with boiler room schemes (as featured in the film ‘Wolf of Wall Street’). In a boiler room scheme – which is illegal – the scammer buys a load of shares in a company. They then contact as many people as possible and persuade them to buy the stock, usually telling them a load of lies about some imminent piece of news which will drive the share price “to the moon”!

When the price goes up enough, the scammers sell and the “marks” are left holding the worthless stock.

The GameStop situation doesn’t seem a great deal different. No doubt some of the early people into the shares made a load of money by essentially selling their stock at the highs to the latecomers. Clearly some of those people also knew a great deal about how Wall Street works (they knew what a gamma squeeze was for a start!).

For now, it seems like they were probably on the right side of the law. There’s nothing illegal about telling people

how great a stock is when you already own it. However, regulators will certainly need to be looking at this and may need to update rules to deal with the social media age.

So, whilst some individual investors managed to take advantage of a Wall Street institution (rather than the other way around as usually happens), apart from a handful of hedge funds, it was mainly individual investors who lost.

And what of Robinhood and their claim to democratize* finance? Well, there’s a saying about technology. If it’s free, then YOU are the product. Facebook is free, but they use your data to target advertisements at you in order to sell you stuff.

On Robinhood, trading is commission-free but they get paid by market makers to send the trades their way. These market makers make a small spread on each trade, but this adds up to a lot if you make enough volume.

So, who are these market makers? Mainly hedge funds of course. And, as they say at the casino, the house always wins…

Market movers

This is all very interesting you might say, but so what? What does it have to do with us?

We saw a short, sharp sell-off in markets around the same time as all this was going on. This wasn’t just confined to GameStop, although that is the most extreme example, but other popular short positions were also targeted.

Short sellers were fearful of big losses and so cut their short positions in case they were the next victims. Most hedge funds hold a mixture of short and “long” positions – stocks they hold in expectation they will rise – often keeping overall market exposure to a minimum.

In order to balance the cuts to their short positions, they had to sell their long positions too, or they would end up with more market risk than they were comfortable with.

In my view, this was a big reason why the market fell towards the end of January, although it has since recovered.

It is very possible that we will have to get used to individual investors moving the market in ways they haven’t before. This may lead to more short-term volatility and big movements in “fashionable” stocks, both long and short.

This might mean even more of a disconnect between fundamentals of companies (boring, old-fashioned things like profits and cashflow) and their share prices than we already see (and we think there is already a bit of a gap!).

The good news is we think there is a big difference between short-term speculation and long-term investing. In the short term, these “stories” make a big difference, but we focus on the long term.

Over any reasonable period, the old, boring fundamentals that we focus on remain just as important as ever before.

*American spelling is deliberate!

These represent Equilibrium’s collective views and in no way constitutes a solicitation of investment advice. The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. We usually recommend holding at least some funds in all asset classes at all times and adjusting weightings to reflect the above views. These are not personal recommendations, so please do not take action without speaking to your adviser.