Divorced from reality?

As we are all too well aware, the coronavirus situation has significantly worsened over the past month or so.

Cases are rising sharply in the UK and we find ourselves back in lockdown.

We’re not the only ones. Further lockdowns have been introduced in many parts of Europe including Germany, Italy and Ireland. Across the pond, hospitals in many southern parts of USA are coming under pressure from increasing numbers of COVID-19 patients.

This of course means the short-term economic situation has worsened with many businesses now severely restricted or unable to trade altogether.

Given what’s happening you might expect that stock markets would have fallen.

However, the opposite is true, and they have in fact performed extremely well. Of course, this is welcome and has helped portfolios to show good returns over recent weeks.

In last month’s newsletter, when talking about Brexit, we essentially said that in the short term it would have a limited impact on markets. We reasoned that the COVID-19 vaccines were much more significant in the short term as they should help spur an economic recovery.

We still believe that we should see a strong recovery later this year provided the vaccine roll-out goes well. However,

the bullish case we made last month was before we knew about the new COVID-19 variant and the further lockdown.

The recovery is likely to happen later than we thought and there will be another sharp downturn first. This more bearish economic outlook is hard to square with the bullish moves in markets.

Given the economic outlook has worsened and markets have moved higher, we think it’s time to be a bit more cautious. We would not be surprised to see a correction in the short term, and so we have therefore reduced equity exposure in our core portfolios.

Valuations

We often use valuation metrics when determining how much to hold in different equity markets.

For example, we look at the ratio between the earnings (profits) of companies and their share prices. The price/ earnings (PE) ratio has historically been quite a good guide to what future returns might be like.

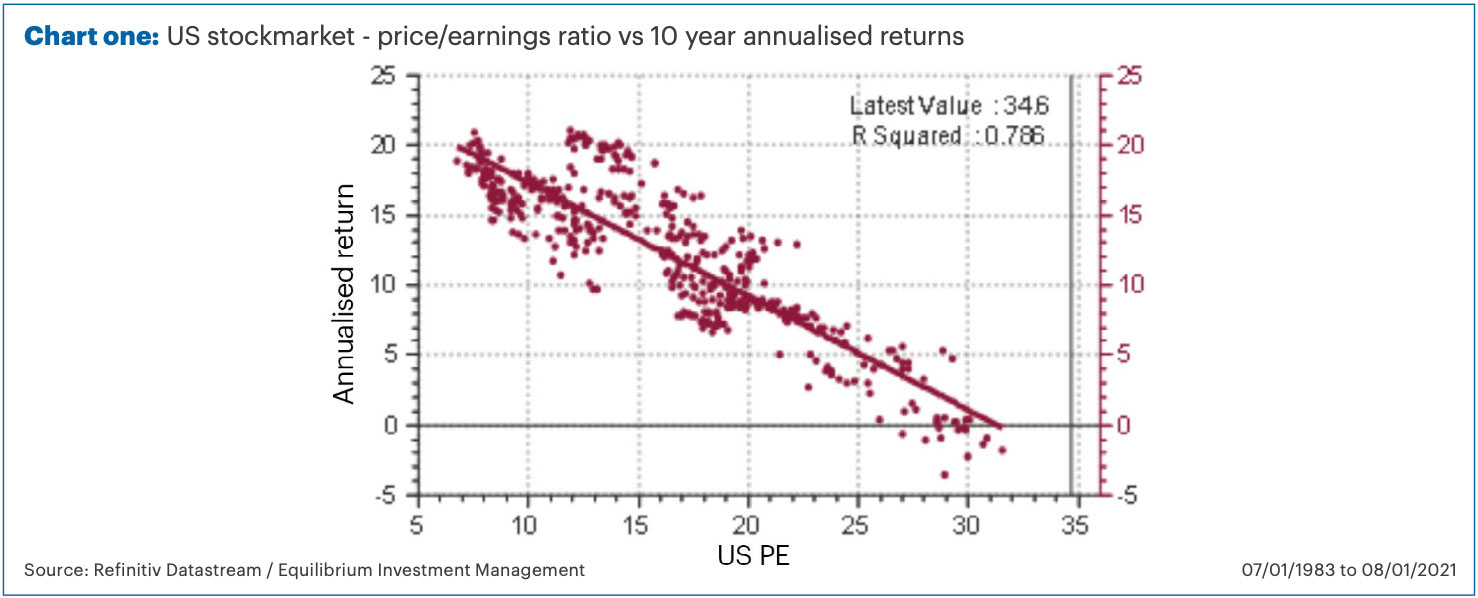

Chart one shows various different 10-year periods in the US stock market. Each dot represents a different 10-year period. The higher the dot on the chart, the higher the return was over that 10-year period.

The horizontal axis shows what the PE ratio of the market was at the beginning of that 10-year period. We’ve typically seen much stronger returns over periods beginning when the PE ratio was low, than periods which began with a high PE ratio.

The 10-year period furthest to the right (most expensive in our data set) began with a PE ratio of around 32 times earnings. There are very few periods where the PE was above 30 and every one of them saw negative annualised returns over the subsequent 10 years.

The current PE ratio is 34.6 (marked on the chart by the vertical black line). This is almost literally “off the charts”. We have never seen a 10-year period where the market was anywhere near as expensive as this at the beginning.

It is worth pointing out that whilst this indicator has historically been a good guide to 10-year returns, as a market timing mechanism it is next to useless. Things that are wildly expensive can carry on getting more expensive for a long time (see also Bitcoin!). We are not saying there is an imminent crash coming, just that the risk of a short-term fall has increased in our view.

Other markets are also quite expensive but not so much as the US.

It is worth pointing out that PE ratios are high partly because the “E” in the equation – earnings – are depressed, hopefully temporarily. There is an argument that those earnings ought to bounce back to past levels when the economy goes back to normal.

Earnings across many markets are down sharply over the last 12 months, perhaps by around 25% as a rough average. If they recover to where they were, that would be an increase of a third from current levels. Such a recovery would bring the PE ratios down to more normal (though still not cheap) levels.

Whilst we partially accept this argument, the recovery has been delayed, and things may now get worse before they get better. The longer we have lockdowns, or other strict rules, the more “permanent” damage we will see, with more businesses in danger of failing.

Essentially, markets are pricing in a very optimistic scenario, and we think there is a real danger of disappointment.

On the defensive

We have just had confirmation from the Financial Conduct Authority (FCA) that our new fund has had regulatory approval.

The IFSL Equilibrium Defensive Portfolio is due to be launched in February. This fund is designed to be lower risk than our current core portfolios. It will target a positive return over rolling three-year periods and a long-term return of 3% per annum more than cash (Bank of England base rate).

Whilst this portfolio is not risk-free, because of the lower expected volatility it may be more suitable for short time periods than some of our other funds. We know some clients have large cash reserves and are frustrated with low interest rates, for example.

If we think it is suitable for you for an element of your portfolio, then we will contact you or will discuss it at your next review. In the meantime, if you would like further information then please get in touch with your usual Equilibrium contact.

General economic view

The short-term economic outlook has definitely worsened as we see further lockdowns and a rise in virus cases in many countries. The vaccines offer hope and we believe economies should recover towards the second half of the year, but will get worse before they get better. Asian economies have generally faired better than Europe or the US.

This environment remains disinflationary and so we expect central banks to keep interest rates on hold and continue with quantitative easing. The Bank of England may even re-consider negative interest rates, although we think more likely they will remain on hold.

Equity markets have generally gone up sharply despite the worsening short term economic outlook. Investors are generally looking through this and betting on a vaccine-led recovery later this year. This leaves some markets looking a bit expensive and vulnerable to any economic setbacks. We have somewhat reduced equity as a result.

We continue to believe the low yields on most government bonds make them unattractive and they have become more correlated to equity markets. There is still value in some areas of the corporate bond market but these do carry more credit risk.

The pandemic has hit the retail sector hard, whilst the move to home working increases the uncertainty for offices. In addition, the FCA are consulting on whether to require notice periods on property funds. This means property is a risky

With interest rates remaining at record lows, returns on cash will remain close to zero for the near future in our view.

For a typical balanced portfolio, we are roughly neutral on fixed interest and have very little property. We are underweight traditional equity but are instead holding more defined returns. The overall risk/return profile of our portfolios is expected to be roughly in line with long-term averages.

These represent Equilibrium’s collective views and in no way constitutes a solicitation of investment advice. The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. We usually recommend holding at least some funds in all asset classes at all times and adjusting weightings to reflect the above views. These are not personal recommendations, so please do not take action without speaking to your adviser.