In this month’s newsletter, Investment Manager Mike Deverell explores the secret to constructing a successful portfolio – diversification. However, he also explains how diversification, if not done correctly, can become di-worse-ification.

Diversification or di-worse-ification?

The secret to constructing a successful investment portfolio is to find lots of good investment ideas which (crucially) all act differently.

No asset is risk free and most of them go up and down over the short term. What we want is to find assets which go up and down at different times whilst demonstrating long-term growth.

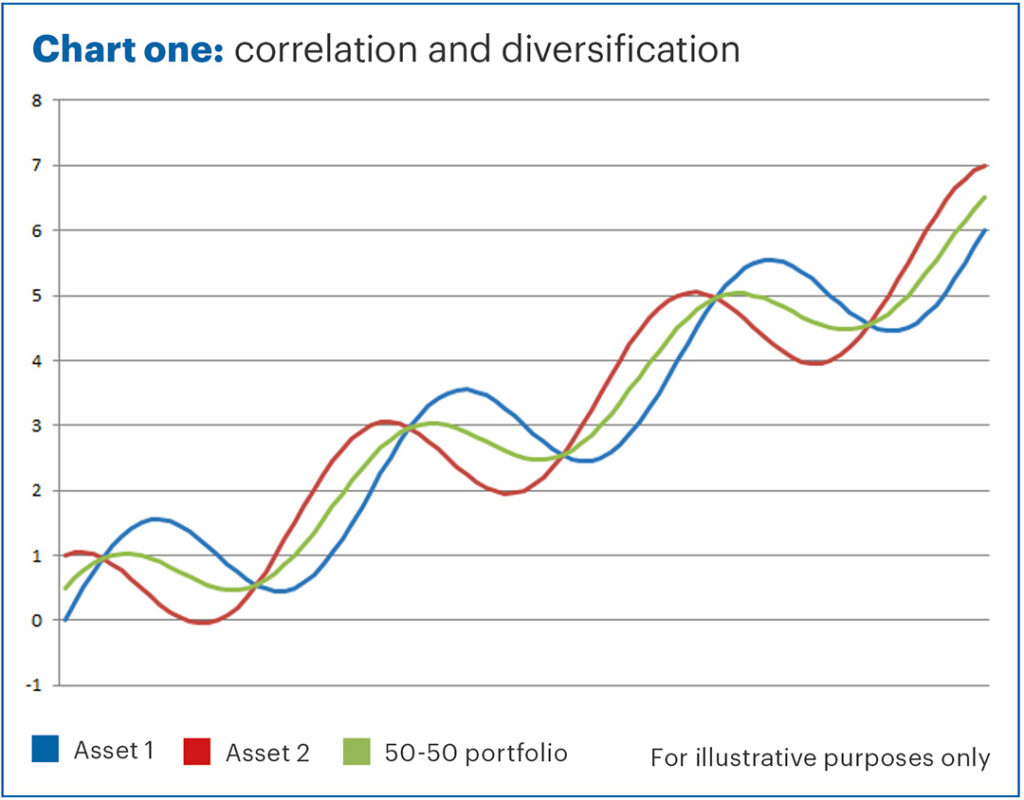

Chart one is a simplified illustration. Asset one and asset two are equally volatile but lowly correlated. By creating a portfolio of both investments, we end up with a smoother ride over time (green line).

By adding in a few more lowly-correlated assets, we can, in theory, make the line even smoother.

However, there is a fine line between diversification and what we call “di-worse- ification”! There comes a point where adding further investments to the pot no longer reduces your risks but starts to reduce your potential returns.

In an ideal world, we’d like all assets to have a high potential return with low correlation, but the reality is somewhat different. For example, equities usually have the highest potential return and highest risk. Traditionally, the best way of hedging equity risk – holding government bonds – tends to have a low potential return.

It is difficult to get the blend right at the best of times. Right now, we think this is even more difficult (and more important) than ever.

Over the past few years, many asset classes have become more and more correlated. For example, during the worst weeks of the pandemic in March 2020, it didn’t matter if you held equities, government bonds, property funds or gold, they all fell.

It required major central bank intervention in the form of huge amounts of quantitative easing, to restore order to markets. All those assets then subsequently rebounded.

Whilst that was only a brief period, more recent correlations have become even more pronounced. As the global economy recovers from the pandemic, markets begin to price in the possibility that some of this monetary stimulus will be withdrawn. That means central banks will start to “taper” QE by slowly reducing it, and eventually they may even hike interest rates.

Raising rates is nearly always bad for bonds, but it is also bad for certain types of stocks as we have discussed in previous newsletters. Notably, this includes some of the relatively expensive but high growth technology stocks, which have done so well from the pandemic.

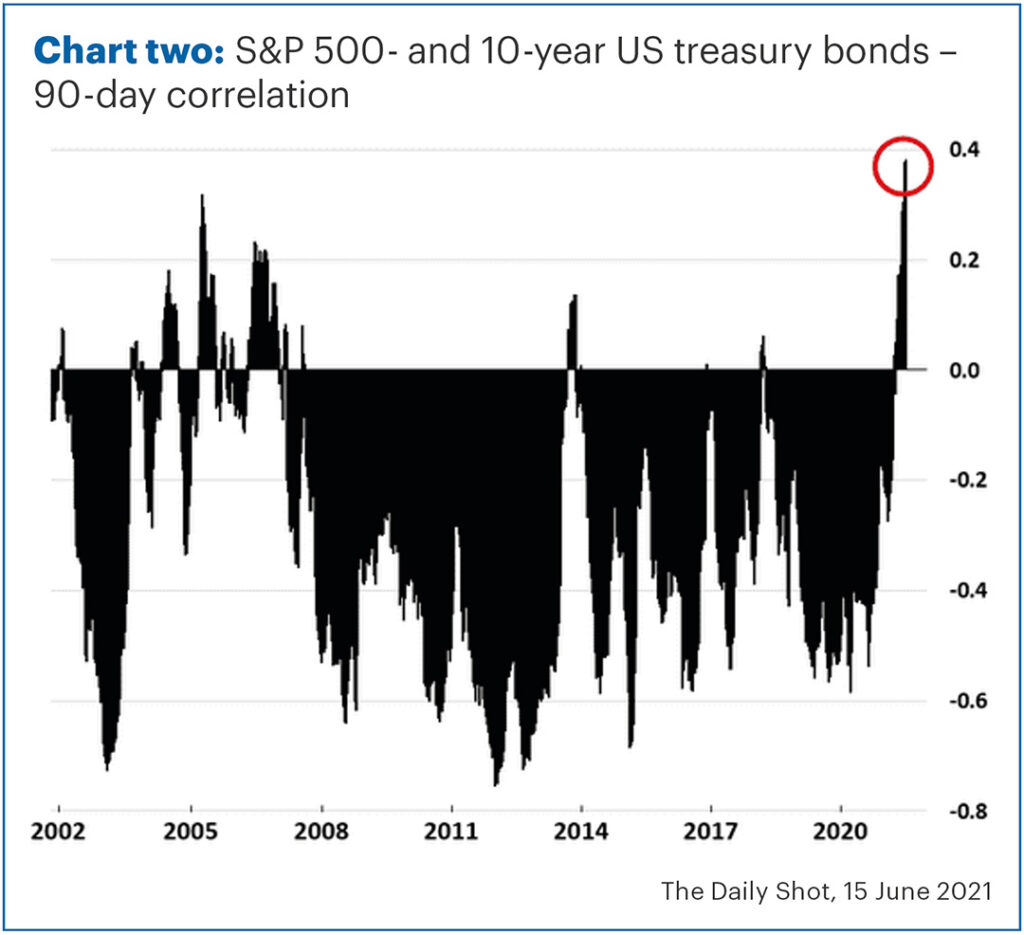

Chart two shows the rolling 90-day correlation between the main US stock and bond markets. Most of the time, the correlation has been negative – bonds and equities move in different directions.

Recently, the relationship has changed, and the two assets are moving in similar directions. The correlation has not been this high since 2005.

We don’t just hold government bonds and equities in portfolios, but also include property, infrastructure, corporate bonds and absolute return strategies. Whilst this all helps, to a large extent these are all still driven by the same things: economic growth rates, interest rates, and central bank stimulus.

Diversify less?

So, what can we do about it? Well, from an asset allocation point of view, there is one asset we can count on as being uncorrelated, which is cash. Unfortunately, this has very little return either!

Whilst we do hold a bit more cash than usual, we can also buy certain types of bonds which are less correlated with equities. Notably, this includes those bonds with short maturity dates (which means less risk and less effect from future rate increases), those with floating-rate income payments (as opposed to fixed rates) or those linked to inflation. Again, these are relatively low returning, but we would expect this to be higher than cash.

We can also take a different approach. If two assets are highly correlated but one has (in our view) a higher potential return than the other, then we can look to enhance portfolio returns by consolidating into one or the other, rather than continuing to hold both. In some cases, this may slightly REDUCE diversification, but we will effectively increase the weightings in those funds in which we have the highest conviction, selling some of our least favourite funds.

As a bonus, because this means we have bigger holdings in certain funds, in many cases we can negotiate discounts on the fund management charges.

To this end, we have recently undertaken an exercise to review all the holdings within our portfolios and identify those which are highly correlated. As a result of this, we have switched out of the Jupiter Strategic Bond fund, the Blackrock European Dynamic fund, and the Polar Capital UK Value Opportunities fund.

None of these are bad funds, it is just that there are other funds we prefer in the same asset class that do a similar job, at a cheaper cost.

We are continuing this exercise and may make a few other tweaks to the portfolios along the same lines.

Diversify more!

Whilst in some instances we can have larger weightings in high conviction investments, there are times when smaller weightings are appropriate.

One area where we have increased the number of holdings recently is in property funds. As the economy recovers, we want to increase exposure to property again, but only in selected areas.

At present, we’re also waiting for the FCA (Financial Conduct Authority) to announce the results of their consultation into property funds following the ‘gating’ of many funds last year. We fully expect them to insist on a notice-period or similar measure in the future. This doesn’t mean we can’t hold property funds, but it does limit how much we would be comfortable holding.

These factors have led us to purchase real estate investment trusts (REITS) instead of traditional property funds. These are essentially companies, listed on the stock exchange, whose sole business is owning and leasing out properties.

We have purchased five REITS in our core portfolios who each focus on specialist areas: supermarkets, social housing, health care (GP surgeries and care homes), and industrial & distribution. The first sectors have very resilient rental income and did well during the downturn, whilst the distribution sector benefits from the switch to online shopping.

Coming back to our discussion about diversification, the benefit of choosing these specialist funds is that they are all doing something different and have therefore been fairly lowly correlated to one another.

Because these companies trade like listed equities, their prices move daily and they can trade at a value which is either higher or lower than the underlying value of the buildings. This can make them more volatile than other types of property fund, and therefore we have only invested around 0.5% of our portfolios in each one.

By getting the right mix, we think we can get some good potential returns whilst keeping risks in check.

Diversification is still a very important weapon in the armoury and the key way we can reduce portfolio risk. However, we need to be selective about how much we use it in different asset classes.

Factsheets

To see the long term strategic allocations for each of our funds, along with the latest monthly factsheets please click here.

These represent Equilibrium’s collective views and in no way constitutes a solicitation of investment advice. The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. We usually recommend holding at least some funds in all asset classes at all times and adjusting weightings to reflect the above views. These are not personal recommendations, so please do not take action without speaking to your adviser.