Now that I’ve got your attention, I should technically rename this blog ‘risk and gender’.

Leading global asset manager BNY Mellon recently undertook an industry wide study into investment attitudes and behaviours of women.

They surveyed 8,000 respondents and 100 asset managers with combined assets under management of nearly $60 trillion. (Source: BNY Mellon Investment Management: It’s time to create a more inclusive investment world)

They found that women are less likely to invest than men, not only compounding existing financial disadvantages but also limiting women’s collective influence as investors.

Shockingly, they found that if women invested at the same rate as men there could be more than $3.22 trillion of additional capital to invest globally.

What’s stopping them?

The research identified three key barriers to women investing;

- The income hurdle: On average, global women believe they need $4,092 of disposable income each month – or $50,000 per year – before investing some of their money.

- The perception that investing is inherently high risk: Only 9% of women report that they have a ‘high’ or ‘very high’ level of risk tolerance to investing.

- The engagement crisis: Globally, just 28% of women feel confident about investing some of their money.

Looking at these barriers, Hanneke Smits, CEO of BNY Mellon, commented, “it’s clear that increasing women’s participation in investment is critical for their personal prosperity and to help shape a more equitable future for all.”

At Equilibrium, we also share this view.

Tolerating Risk

Whenever you undertake an investment, it is likely you will be asked to complete a risk tolerance questionnaire.

These questionnaires are designed to provide you with a ‘risk score’ which can then be compared to a representative sample of the investing population, with 50 being the average score.

In its simplest form, the outcome of assessing your risk tolerance is to match your score with an investment portfolio that will be the highest risk portfolio you could hold without feeling uncomfortable.

Our clients complete a Finametrica risk profiling questionnaire and this research prompted us to carry out our own.

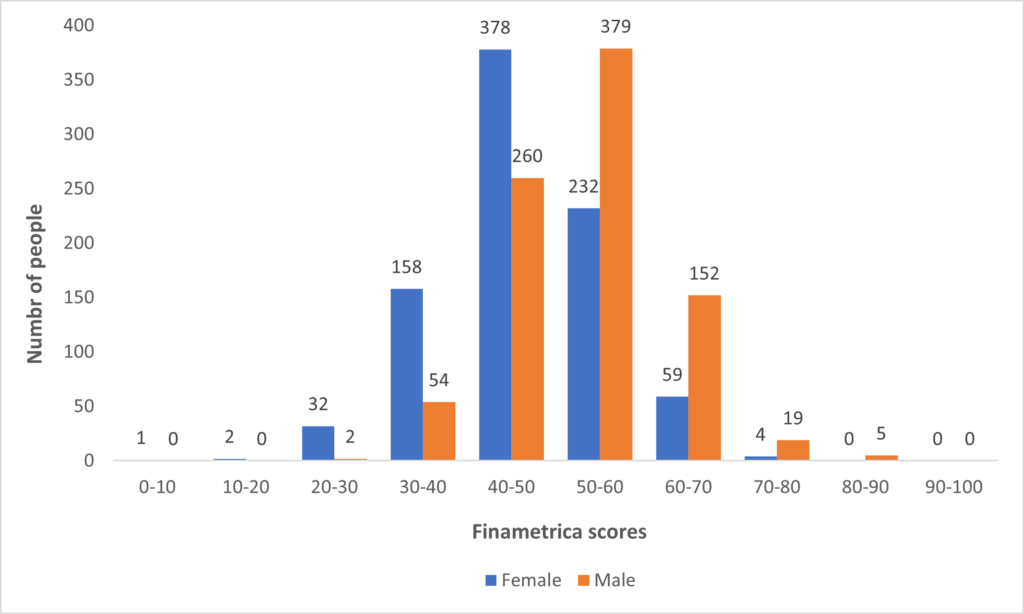

We have over 2,056 clients of which 1,085 are men and 971 are women.

Interestingly, the average risk tolerance score was 49.98. However, when broken down by gender, the average male score was 53.04 compared to an average female score of 46.56.

The below graph also illustrates how those scores are distributed. We can see from the graph that the number of male clients who scored between 60-70 was 2.5 times more than women.

Source: Equilibrium Financial Planning – December 2021

Looking at our results, it would appear to corroborate the results found by BNY Mellon – 6.5% of female clients would be classed as having ‘high’ or ‘very high’ risk tolerance compared to 9% found by BNY Mellon.

But this brings me onto the important question……..

Should risk tolerance matter?

Imagine I have two clients with identical circumstances. They are exactly the same age and they have the same assets, liabilities, incomes and expenditure requirements.

On this basis, surely they should have the same investment strategy?

Now, imagine one is a man with a risk score of 55 and the other is a woman with a risk score of 45.

They have the same needs, however, based on risk tolerance alone, one might be recommended a cautious portfolio whilst the other an adventurous one.

Over the last 10 years (up to 28/02/2022), the difference in returns between the two portfolios based on the same initial investment of £500,000 would be nearly £150,000!

This is the ‘risk’ of risk scores, they don’t take into account the individual circumstances of the individual.

Managing Risk

At Equilibrium, we believe that the risk you take, should be based on your needs. Tolerance is important but it is secondary to the risk you need to take to achieve your goals.

To do this we undertake a process called horizon planning. We work with clients to establish the purpose of their money and when capital or income might be needed. We then record these requirements onto a timeline:

- Short Term: typically the first 5 years

- Medium Term: usually the subsequent 15 to 20 years

- Long Term: everything thereafter.

Each of these horizons is then assigned a pot of money from the portfolio.

- Pot 1: Reserve (short term/defensive)

- Pot 2: Income (short term/balanced)

- Pot 3: Growth (short term/global equity)

These pots can then be invested at an appropriate level of risk corresponding to the horizon timescale.

The outcome of our horizon planning process is a strategy tailored to a client’s personal circumstances. It also ensures that risk is allocated based on their needs and the portfolio has the flexibility to provide for a client’s needs regardless of market conditions.

Ultimately, our process is designed to provide the right outcome and risk allocation based on the needs of the individual.

There is a limit to the impact we can have on the inequalities faced by women globally. However, improving the understanding of risk is a step towards overcoming the barriers women face when approaching investments and money.

This blog is intended as an informative piece and does not construe advice. If you have any further questions, please don’t hesitate to get in touch with us using the form below or by reaching out to your usual Equilibrium contact.