A fine balance

We always say that volatility is an opportunity for long-term investors.

Market falls mean we get an opportunity to buy assets which we want to hold for the long term, at a cheaper price.

It’s fair to say, this year has presented lots of these opportunities. We see these as a key way to enhance long-term returns. Of course, by buying assets on the way down, we often make losses worse in the short term.

Unfortunately, neither Equilibrium or anyone else can tell you in advance whether we’re at the bottom (or the top) of a market. Our approach is therefore to constantly rebalance portfolios, buying on the way down and selling on the way up.

This process makes sure we’re not taking on too much risk when things are rising (meaning we would be harder hit by a correction), or too little risk when things are falling and therefore, we might miss out on a recovery.

Often, this means we’re counter-intuitively buying risk assets like equities when everything looks gloomy or selling when everything appears great.

Long-term clients may remember many times in the past where we’ve taken this approach and have seen it work in practice. In this bulletin, we explain some of the actions we’ve taken this time around and why we believe they’re the right thing to do in the long term.

We’ll also look at some past examples where we’ve taken this approach.

Active management

We are trading in the portfolios almost every day, topping up things that have fallen, trimming gains where appropriate, and generally rebalancing the portfolios.

After the Russian invasion of Ukraine, one of our first actions was to sell a large part of our fixed interest funds and hold this in cash, pending a decision to reinvest.

As of the end of December 2021, the IFSL Equilibrium funds held assets under management of just over £1.1bn. This year to date (27 June), the sales of fixed interest across all our funds totalled £191m. Some of this has since been invested back into fixed interest, largely into high-quality government bonds after they had fallen a long way.

Much of the balance went into equities and other growth assets such as infrastructure and property. In total, the net purchases of equity within the IFSL Equilibrium funds this year have been over £106m.

On the face of it, this might imply that we’ve topped up equity by almost 10% on average, yet the eagle-eyed amongst you who track our asset allocations will not see that it has increased as much as that.

This figure partly reflects inflows to the funds which needed to be invested, but largely it reflects the rebalancing we have done so far this year.

In simple terms, if we started with a portfolio of 50% in equity and 50% in cash and stocks fell by 10%, we would now have only 45% equity and 55% cash. Just to maintain the position, we would need to buy 5% more equity.

It’s far more complicated in reality, since we are looking at this daily and making relative decisions between numerous different funds and asset classes. However, the point is that we are being very active behind the scenes in order to keep portfolios on track. Imagine a sailing ship trying to stay on course, where constant changes and corrections are required just to keep going in the right direction.

As well as the regular rebalancing, we have also increased allocation to growth areas since the start of the year.

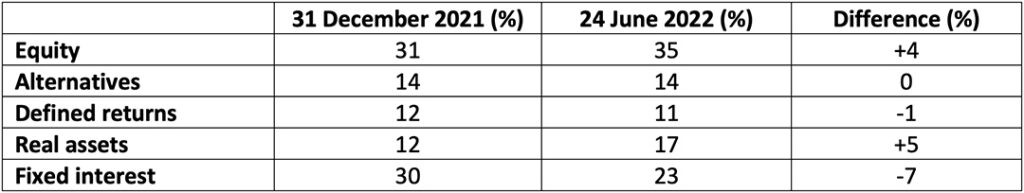

Table one (below) summarises the changes to the asset allocation of the Balanced portfolio from 31 December 2021 to 24 June 2022*:

*The above figures are approximate values and exclude cash. Source: Equilibrium Investment Management

Equity has increased by 4% and real assets (infrastructure and property shares) by 5%. This was partially offset by a 1% reduction in defined returns, as we had some products kick out earlier this year. As a result, there has been a net increase in equity and other growth assets of around 8% of the portfolio.

We have made similar changes to our cautious and adventurous funds, to a greater or lesser extent. The tables for these are at the end of this bulletin.

We will shortly be producing our regular quarterly reports for each fund, which will provide more detail on changes made to asset allocations and funds, and what has added or detracted from returns.

Past pain, long-term gain

Our approach to volatility has been tested many times in the past, most notably two years ago during the height of the pandemic.

This was another period where with hindsight we were “too early” to top up, but despite short-term falls, these trades ended up adding a significant amount to returns.

One example is where we added to our defined returns exposure, buying a product from Goldman Sachs in early March 2020 when the FTSE 100 was at 6,000.

This product promised to pay a return of 20% p.a. should the market be at or above 6,000, at any of the first six anniversary dates of the product being set up.

At the time, we felt this was – if not quite a no-brainer – too good an opportunity to turn down. However, a few weeks later when markets fell below 5,000 and the product was down around 20%, we possibly looked a bit silly.

In the event, the market recovered, and this product kicked out in the first year, producing the promised 20% return, but not before it had seen some pretty steep short-term losses.

Perhaps it’s easier to take this long-term view with a fixed-term product such as defined returns. After all, what were the chances the FTSE never recovered back above 6,000 over the following six years?

However, the same principle applies to our other purchases too.

Exciting opportunities

We think there are many examples of purchases we’ve made in the portfolio, where the potential return is at least as great as in the Goldman Sachs example above, but which in the short term have detracted from returns.

For example, up to the end of May 2022, the average building in the industrial property sector produced a total return of 11.5% from a combination of rent and capital growth. (Source: CBRE)

We invest in the industrial property sector through a couple of listed property investment trusts, Segro and Tritax Big Box. The share prices of these funds have fallen sharply this year, down by 31% and 24% respectively. (Source: FE Analytics to 31 December 2021 to 13 June 2022)

This means that these funds now trade at a big discount and the value of the underlying buildings is worth significantly more than currently reflected in the share price. These discounts are estimated at 15% and 12% respectively. (Source: Panmure Gordon, based on forecast Net Asset Value)

We think this is a great opportunity to add to a long-term growth area at a very attractive price.

In equities, we recently topped up the Miton UK Multi Cap Income fund. According to Morningstar, the companies within the portfolio are currently valued at 7.6x their underlying earnings. By contrast, the FTSE 100 currently trades on over 15x earnings. (Source: Refinitiv Eikon)

This is despite consistent earnings growth of over 10% p.a., which is projected to remain at similar levels in the future.

If we can purchase a portfolio of shares at half the valuation of the market, where the companies are growing consistently, this is clearly something we want to hold for the long term.

Of course, even if this growth continues to be achieved, the market may take some time to recognise the value. The good news is we are being paid to wait, as we’ll continue to pick up a dividend yield of 4.5% in the meantime.

There are numerous examples in portfolios where we think some fantastic value is emerging if we can be patient. This also includes buying both US and Chinese technology companies at a significantly lower valuation than we might have seen a few months ago.

Horizon planning

Our advisers spend a lot of time with clients talking about time frames.

Where clients might need to take some money out of the portfolio in the short term, we will recommend we invest very cautiously (or even keep money in cash). For medium-term money, we might advocate a balanced approach for example.

We will also identify any money that may not be required for 10 or 20 years (or in some cases, ever), and for this we may invest completely differently. Often, clients may agree that we should take much more risk in search of higher long-term returns. This is because we can ride out volatile markets and don’t need to crystalise short-term losses by selling at lows.

When managing portfolios on a day-to-day basis, the investment team takes a very similar approach.

For the cautious fund, we spend as much time focusing on the risks as we do the return. We will be cautious about topping up as markets fall, and relatively quick to bank gains when we get them.

For our adventurous or global equity funds, we take a much longer-term focus. Even if we think an asset could be volatile, we will be asking ourselves, “do we want to own this for the next 5 or 10 years?”

If the answer is “yes – this fund has attractive long-term growth prospects”, we will hold or top up even if we think it could get worse before it gets better. We can never know if we’re at the bottom of the market, but we can make a judgment over long-term growth prospects.

At a more macro level, despite the short-term doom and gloom you read in the press, it’s worth remembering that the global economy is predicted to double in size between now and 2035.

It is also predicted that China will have overtaken the US to be the world’s largest economy by 2030. India will have moved from its current fourteenth position to third place, behind the US, by 2035. (Source: https://www.visualcapitalist.com/shifting-global-economic-power/)

If the global economy does indeed double over this period, I have little doubt that the stock market will do extremely well. After all, what is the market but a collective expression of this growth.

If, as predicted, China and India rise to prominence, then we want to be well exposed to these countries. We hold more than most in all our portfolios, but particularly in the more adventurous funds.

In the short term, this might increase the risks, but in our view, makes sense in view of the long-term potential returns.

Appendix

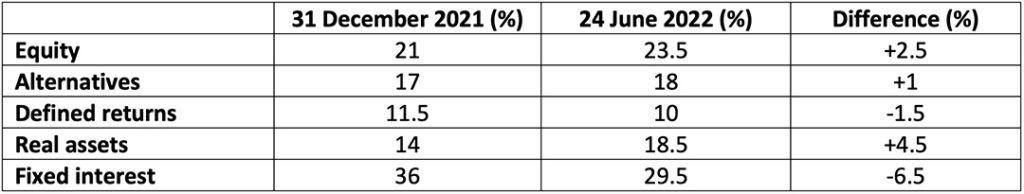

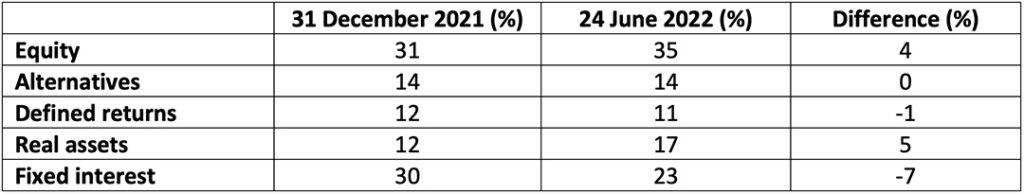

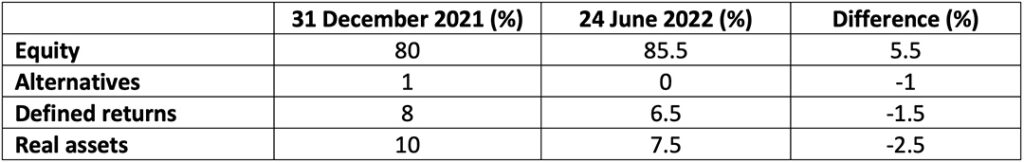

The following tables summarise the asset allocation changes for our other funds from 31 December 2021 to 24 June 2022.

Table two – Cautious

Table three – Balanced

Table four – Adventurous

Table five – Global Equity

*The above figures are approximate values and exclude cash. Source: Equilibrium Investment Management

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This blog is intended as an informative piece and does not construe advice. If you have any further questions, please don’t hesitate to get in touch with us using the form above or by reaching out to your usual Equilibrium contact.