Time to re-think

“When the facts change, I change my mind, what do you do sir?”

This quote is widely attributed to the economist, John Maynard Keynes, and is something of a mantra on the investment team.

We’re never wedded to a previously held view, fund holding or asset allocation position. We’re led by data and evidence. If that evidence points to something different from what we had previously thought, we will change our minds and the portfolio positioning.

Recently, a couple of facts have changed which have caused us to do just that.

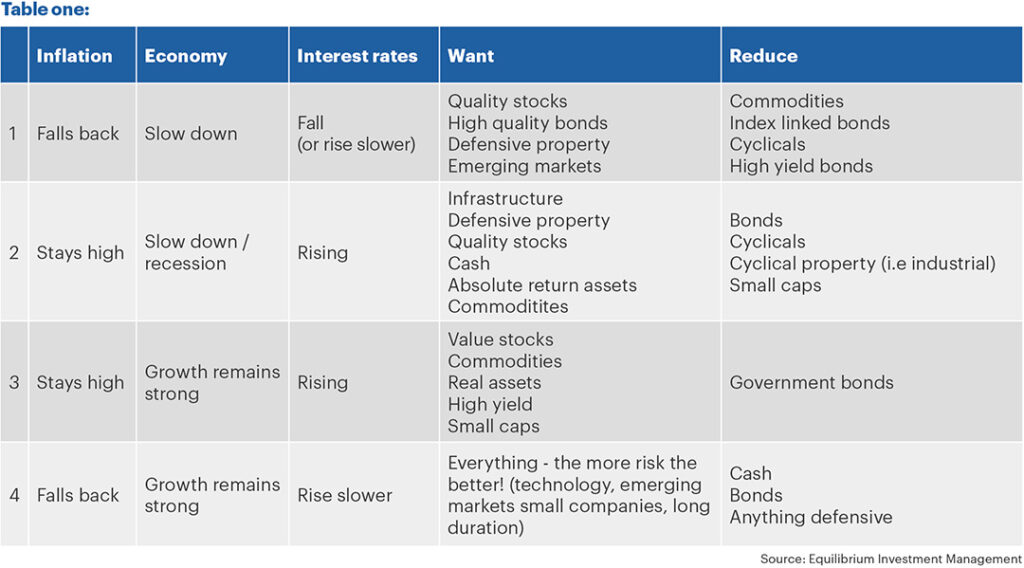

In June’s edition of The Pulse, we included the below table which describes four potential scenarios for the economy and gives our views about which asset classes might prosper or struggle in each scenario.

We said at the time that we thought scenario one was the most likely outcome – inflation would drop back, interest rates wouldn’t go up as much as the market expected, and the economy would slow, but not necessarily fall into recession.

At the time, the market was positioned for scenario two – persistent high inflation, higher interest rates and a recession.

We said we would position for scenario one but try to hedge the risk of scenario two by increasing inflation protection in the portfolio.

What’s changed?

Firstly, whilst we’d still expect inflation to drop next year, it will likely move higher than expected in the short term. We think that central banks will therefore continue to put up interest rates as they have staked their credibility on bringing down inflation. Central banks are prepared to induce a recession to bring inflation under control.

In our view, the economic outlook is somewhat worse than a few months ago, something more akin to scenario two above. However, at the same time, the stock and bond markets have become MORE confident about the future.

In fact, over the past few months, the implied level of inflation in market prices has fallen, as have bond yields (which express the market’s expectations for future rate hikes). Meanwhile, both equity and bond prices have rallied from their lows of early June.

In other words, the market has gone up and investors have become more complacent even as the outlook has worsened. As a result, we have decided to reduce risk in some of our portfolios.

For example, a few months ago we purchased a Nasdaq Index tracker fund. We have now sold this in cautious and balanced portfolios at roughly an 8% gain compared to when we purchased. We have also taken profits in adventurous but retained in global equity for the time being.

Within equities, we are reducing exposure to the more cyclical areas of the market. In particular, we think the outlook for the UK and Europe is more challenged than other regions. We are already underweight in Europe and are now reducing UK exposure, particularly to smaller companies, in favour of greater exposure to large global companies with resilient earnings.

We are also reducing exposure to fixed interest again (having topped up at relative lows a few months ago) as we now think the yields don’t reflect the likely rate hikes. We are instead increasing alternative strategies, such as absolute return.

Why have we changed our views?

We now believe a recession is very likely. This is mainly because energy prices have continued to rise, and this is having some second-order effects.

We recently met a strategist from a large investment house, who told us of a conversation he had with his local chip shop owner.

This small business had recently come off a fixed rate energy deal, having been paying around £7,000 a year (a chip shop uses a lot of energy). Their new bill is likely to be closer to £80,000 a year!

That is clearly unsustainable – either the price of fish and chips will have to rise to a point where people just won’t pay, or the shop will have to adapt to only open at peak times (leading to redundancies). Or perhaps they will simply go out of business.

We have already seen some government support for individuals in the form of rebates on their energy bills. However, businesses have not been so fortunate.

We expect the government will unveil much wider stimulus to help not just individuals, but businesses too.

We also worry that Vladimir Putin may see this as an opportunity to squeeze the UK and Europe even more, by reducing the gas supply during the winter when it is most required. Of course, that is just speculation, but it is a potential risk.

As usual, it is possible we could be wrong! Hopefully, any government intervention is enough to support the economy; and central banks take a sensible view and refrain from hiking interest rates too much.

However, we think the risks have risen whilst markets have become more complacent.

To be clear, these are short-term tactical moves and any further pullbacks in equity or bond markets would see us consider topping up again.

We still think that over the long term, equities will produce the highest returns. However, in our more cautious and balanced funds, we think it sensible to reduce risk at this time.

The long–term inflation outlook

We have always taken the view that inflation is likely to return to its recent trend of around 2% p.a. (or even below), over the long term.

We continue to believe that most of the current drivers of inflation are temporary, and inflation should fall back next year unless something else happens in the energy market.

However, looking longer term there are now more reasons to think that inflation may be structurally higher than we had felt previously. Perhaps 2.5% to 3% p.a. rather than 1.5% to 2% as we’ve seen over most of the last decade.

That’s because inflation has been kept low previously by three factors; cheap energy, cheap goods, and cheap labour.

Cheap energy may be a thing of the past. Not just because of what’s happening at present, but also because of the need to transition away from fossil fuels to more renewable sources. Perhaps once the transition is complete it may become cheaper, but in the meantime, a lot of investment is needed in our energy infrastructure.

De-globalisation forces may mean that goods are no longer as cheap, as countries look to bring manufacturing back closer to home. Meanwhile, cheap labour may also be less likely for the same reasons, and as countries look to discourage immigration.

Of course, as physicist Niels Boer once said: “Prediction is very difficult, especially if it’s about the future.”

Unfortunately, we do not have a crystal ball, but we do try to consider possibilities such as this and any other long-term themes we think will drive investment returns.

Luckily, many of the assets we hold in the portfolios have direct linkage to inflation. This particularly applies to some of the property and infrastructure funds.

In addition, some of the drivers mentioned above could also have a positive effect on returns. For example, the investment in fighting climate change could boost our renewable energy holdings.

As usual, what is a risk for one asset class can often be a positive for another and having a diversified portfolio, therefore, remains extremely important.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This newsletter is intended as an information piece and does not constitute a solicitation of investment advice.