Long-term decision making

We call this newsletter “the pulse” as we use it to bring you our latest views on markets.

We try and explain what is causing current market moves, what might happen in the future, and any changes we’re making to portfolios as a result.

Of course, that means we inevitably focus on what’s happening in the short term. However, investing is all about the long term.

For our core portfolios, we recommend investors hold for at least five years. This is because in the short term, markets can be volatile. For our global equity portfolio, we recommend holding closer to ten years.

Even when we’re adapting portfolios to short-term changes in market conditions, we’re doing so with the long term in mind.

Accepting what we don’t know

This long-term focus is especially important at present when markets are being buffeted by geopolitical events. We have no more idea than anyone else how the situation in Ukraine will play out over the long term, how quickly it might be resolved, or how much worse it might get.

For this reason, we won’t make changes to portfolios based on headlines or assumptions about things nobody can predict.

However, where there is an asset class we want to be invested in for the long term, which has fallen sharply in the short term, we can use this as an opportunity to buy at a cheaper price.

That doesn’t mean we’re trying to call the bottom of the market downturn; we are instead taking a long-term view of an asset class which looks to be good value.

For example, in the short term, adding to equities or similar assets could make returns worse if markets continue to fall, but it also increases the long-term growth potential.

What can we reasonably assume?

Whilst there are many things we don’t know, there are things we can assume with a reasonable degree of confidence.

We can reasonably assume that even if there was an end to conflict tomorrow, sanctions would not be dropped completely and trade with Russia would not go back to previous levels any time soon. Commodity prices would probably not drop back to their pre-conflict levels very quickly either.

This means inflation will probably go even higher than we first thought in the short term. As mentioned, a few weeks ago, there is a risk that this causes an economic downturn as people have to spend more of their income on the essentials like food and energy. We still hope this can be avoided, but the risk has certainly increased.

We think this situation will spur countries on to make their energy supply chains more secure, which will also include further spending on renewable energy.

From an investment point of view, we feel this furthers the case for investing in infrastructure. This is an area we believe has great long-term prospects and as such, we’ve taken the current opportunity to top up.

Similarly, another asset class we think has great prospects is industrial property, particularly distribution warehouses. There is simply not enough supply to meet demand at present, as more people want to buy goods online.

Both property and infrastructure tend to see their incomes increase with inflation.

According to property experts CBRE, the underlying assets in this sector (CBRE monthly index) achieved a total return of 4% in January and February combined.

However, the industrial property companies we invest in are listed on the stock market (they are real estate investment trusts, commonly known as REITs) and so have fallen along with other stocks. For example, from 31 December 2021 to 8 March 2022, our holding in Segro plc was down 14.31% (source FE Analytics).

This highlights where sentiment is poor, sometimes the sell-off can be indiscriminate. It doesn’t make a great deal of sense to us that an underlying asset can be up 4% and the shares in a company investing in that asset are down 14%.

We have therefore taken the opportunity to add to Segro and to purchase another REIT in that sector (Tritax Bix Box).

Short-term and long-term performance

The current market situation is of course affecting portfolio returns in the short term. Remember that markets were falling even prior to the Ukraine conflict, hit by expectations of rising interest rates.

However, the current behaviour of portfolios is in line with what we should expect and what we have seen historically.

Table one (below) shows the discrete annual returns of our core portfolios over the last 10 calendar years, including the current year to date. It compares the returns against the average fund holding between 20%-60% in shares, a similar range to our portfolios.

Warning: Undefined array key "caption" in /srv/users/equilibrium-dev/apps/equilibrium-dev/public/wp-content/themes/equilibrium/partials/image-block.php on line 4

So far this year, the cautious portfolio is outperforming and has fallen less than sector. Balanced has fallen slightly more than sector in the short term, whilst adventurous has fallen quite a lot more.

Remember this is a very short period over which to assess returns but given the levels of risk we are taking in each portfolio, this is roughly what we would expect to see.

Looking back at the last 10 calendar years, we see that cautious is most likely to outperform when the sector returns are low or negative. Adventurous tends to outperform most strongly when markets rise. Balanced tends to be fairly consistent in the middle.

Over the past decade, the cautious portfolio has outperformed the sector seven out of 10 years, whilst the balanced portfolio has done so eight years out of 10. Adventurous has outperformed nine years out of ten.

There will inevitably be periods where we underperform in the short-term. For example, in 2016, our balanced portfolio underperformed, but it then outperformed the next four years in a row.

One year worth highlighting is 2020, when portfolios were hard hit at the beginning of the pandemic. During that period, portfolios underperformed in the short term, particularly after we topped up equities as markets fell.

This approach hurt short-term performance, but the increase in risk on the way down led to outperformance over the longer term. Balanced and adventurous ended the year outperforming, with cautious only marginally behind.

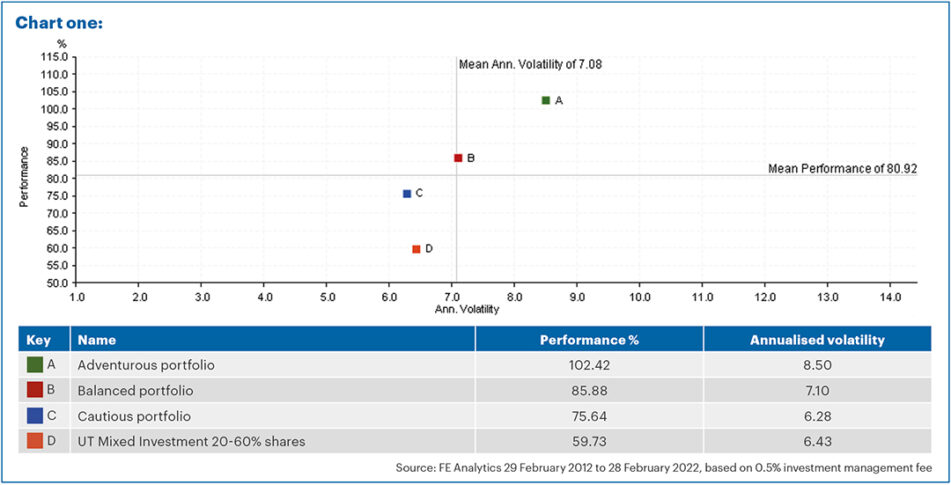

Chart one (below) shows the full 10-year returns of each portfolio and the sector on the vertical axis. It also shows the level of volatility of each along the horizontal axis.

Warning: Undefined array key "caption" in /srv/users/equilibrium-dev/apps/equilibrium-dev/public/wp-content/themes/equilibrium/partials/image-block.php on line 4

Over 10 years, the average mixed investment fund returned 59.73%. Over the same time period, our cautious portfolio returned 75.64% whilst taking less risk than the sector. Balanced returned 85.8% whilst taking on slightly more risk, and adventurous was more volatile but returned a healthy 102.42%.

What is helping and hindering short-term performance?

We try to keep a mix of assets in portfolios which will do well in different environments. However, there are a few long-term “tilts” we can make to the portfolio which we think will increase the chances of long-term outperformance.

The first tilt is to have more exposure to smaller companies than most similar portfolios. Various academic research has shown that smaller companies tend to outperform larger ones over the long term.

Secondly, we will typically have more emerging market exposure than many others. This is because the underlying economic growth in the likes of China and India is expected to be far higher than in the West. We therefore think this tilt also increases the chance of superior long-term returns.

In the long term, we believe this is the right approach, but in the short term, these two areas are underperforming. Both can be risky and more susceptible to economic events.

Table two shows the UK equity funds we hold. It provides the returns over the past three years as well as the returns so far in 2022.

Warning: Undefined array key "caption" in /srv/users/equilibrium-dev/apps/equilibrium-dev/public/wp-content/themes/equilibrium/partials/image-block.php on line 4

All our UK funds have underperformed the FTSE Allshare Index so far this year. This is because the oil and gas giants have helped the large cap index to hold up relatively well, but smaller companies are down significantly. The FTSE 250 index of medium sized stocks has dropped 13.67% so far this year, and the FTSE AIM Allshare (smaller companies) is down 18.07%.

However, over three years, all our UK fund holdings outperformed, in some cases, by a long way. We make our fund selection decisions based on their long-term track records, not short term.

One thing which has worked well for the most part this year, has been our holdings in ‘Defined Returns’. We had two products kick-out so far this year, providing excellent returns over their holding period.

The kick-out proceeds provided cash we can use to buy equities at lower levels, including small increases in UK smaller companies and emerging markets. We also added a new defined returns product which has a long-term potential return of 10.95% pa.

Again, we are not making our investment decisions based on some expectation that we know better than anyone else what is going to happen in Ukraine. However, the situation does give us the opportunity to top up areas we think will provide long-term outperformance, at what we think are temporarily lower prices.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.