Bears and bonds

Executive summary

- The pound and UK government bonds have sold off sharply since the mini-Budget.

- This is due largely to the outlook for the economy, inflation, and interest rates.

- It is also partly due to supply and demand. It is NOT about the solvency of the UK government.

- The current turmoil creates opportunity for investors. Whilst we can’t predict how this will play out in the short term, we are focused on investments where we have a high degree of confidence that they provide attractive long-term returns.

Within portfolios, Equilibrium has recently purchased (amongst other things):

- A defined returns product which will return 15.2% p.a. as long as the stock market doesn’t go down over the next five years.

- A “defensive” defined return product which will return 10.42% p.a. even if the stock market goes down by as much as 20% over six years.

- High- quality corporate bonds at an estimated 8% p.a. yield.

- Financial bonds (lending to banks and building societies) at an estimated 11% p.a. yield.

It’s safe to say, this year has been a tough one for investors globally.

Stock markets are generally in bear market territory, defined as a 20% or more fall. For example (as I write this), the main US, European and emerging market indices are all down between 21% and 25% since the beginning of the year, as is the FTSE 250 here in the UK. (Source: FE Analytics 21 December 2021 to 11 October 2022, in local currency terms. S&P 500, MSCI Europe ex UK, MSCI Emerging Markets).

Whilst that’s painful, we know stock markets do go down from time to time and typically recover given a long enough time horizon. What is perhaps more shocking, is how badly bonds have done and how this has happened at the same time.

The main UK government bond index, the FTSE Actuaries UK Gilts Index, has fallen by more than any of those equity indices mentioned and is down 29.84% so far in 2022 (as of 13 October 2022).

Again, the fall in bond markets is a global phenomenon as inflation and interest rates go up everywhere. However, here in the UK, we have seen some of the worst falls.

‘Gilt’ trip

Since the mini-Budget, UK government bonds (gilts) have sold off sharply.

The price of the bonds has fallen which means the yields have gone up. That has all sorts of implications for the wider economy; it means the interest rate the government pays on its debts has gone up, which has a knock-on effect on things like mortgage rates etc.

However, it is vital to get across that this sell– off is not due to concerns about the solvency of the UK government.

There are two main reasons that investors are demanding a higher interest rate for lending to the UK government:

- Supply and demand – given the tax cuts and spending commitments, the supply of gilts is likely to be much higher than previously anticipated. If supply increases but demand remains the same, prices go down.

- Inflation and interest rates – more money being pumped into the economy via tax cuts could mean higher inflation for longer in the UK. This means that interest rates may need to go higher to bring this under control.

The government says it will explain how it will pay down debt over the long term at the end of October. It may well require some big cuts in government spending, which tends to lead to lower economic growth. This is another reason the pound has fallen which is investors believing there is better growth outside the UK and therefore moving their money elsewhere.

However, this is not the same as an increase in default risk on gilts. The government can always decide to reduce spending and/or increase taxes in order to pay its debts.

In addition, UK government bonds are denominated in sterling. We have our own currency and in extremis, the government could order the Bank of England to “print” money to repay gilts as they mature. Sterling may well be worth a lot less in this scenario which would be inflationary.

We should emphasize that this is a very extreme and, in our view, a highly unlikely scenario. However, the fact that we are even talking about this possibility may speak volumes.

Liability-driven investing

One reason the movement in gilts has hit the headlines is because the Bank of England was forced to step in to buy bonds in the short term, to maintain financial stability.

(This bit is somewhat technical, so feel free to skip to the next section if you prefer.)

In essence, many defined benefit pension funds have long-term liabilities in the form of pensions they have promised to pay. They like to match the investments they hold to those liabilities – for example, by holding bonds with the same length of time to maturity as the liabilities, they then use the coupon payments to fund the pensions.

However, because bond yields have been so low for so long, in order to provide enough income to pay the pensions, many funds have “geared” their investments – in other words, they have borrowed to invest.

As the price of gilts has fallen so sharply, the pension funds have been asked to provide additional collateral against these loans. As a result, they have been forced to sell assets very quickly, which has largely meant selling gilts, accelerating the drop in price.

The Bank of England stepped in to ensure liquidity and help pension funds to repay these debts.

Again, this all exacerbates price volatility but not the long-term security of lending money to the government.

Seeking certainty in an uncertain world

As discussed in previous editions of the Pulse, the short-term outlook is extremely uncertain.

Our approach is always to try and step back and view the various asset classes taking a longer-term perspective.

It also pays to keep things relatively simple; to focus on those investments in which we have the most confidence in achieving the returns.

The good news is that there are currently many opportunities which both have a high potential return AND where we have a high degree of confidence.

We don’t know if the stock market will go up or down over the next few months. However, we think it’s very unlikely it will go down over the next five years.

Should we be correct in this assumption, the new defined return product we have purchased in most portfolios, will prove to be a very successful investment. This will pay a 15.2% p.a. return provided the market is the same or higher than its starting level on 30 September 2022 (when the FTSE 100 was at 6,868 and the S&P at 3,641) over the subsequent five years. Even if the market drops sharply and remains below where we started for four years and 11 months, provided we get back to the starting levels by the fifth anniversary, we will get a return of 15.2% p.a.

We have also set up a second defined return product, which is more defensively positioned. The potential return is still an attractive 10.4% p.a., but this time we get the return even if the market drops over the next six years, provided that the fall is 20% or less.

The product was set up when the FTSE 100 was at 7,052 (and the S&P 500 at 3,783). This means the FTSE could drop to 5,652 over the next 6 years and we would still get 10.4% p.a.

If the markets are below the levels stated, then we just get our original capital returned (no gain or loss), provided they are less than 40% down over the term.

We think these are extremely exciting investment opportunities. So, what’s the downside?

Both products are giving up the chance of higher returns in favour of increased certainty around that return. Of course, the market could go up 20% or more, but the defined returns will still only provide the headline rate.

We are also taking on counterparty risk with Morgan Stanley and Goldman Sachs respectively. In the unlikely event that either of the banks default on its debts, we could lose our capital.

Boring bonds?

Whilst in the short term gilt prices are very volatile, if we take a long–term view, this uncertainty drops away.

If we lent money to the UK government today for 10 years, we would get an annualised return of 4.5% p.a. (Source: Refinitiv Eikon). The only reason we would not get this return is if the government defaulted on its debts or if we decided to sell the bonds before they matured.

The same is true of a corporate bond. The risk is higher because we lend the money to a company rather than a government. Again, if we hold the bonds until maturity and the company doesn’t default, we know what return we will get.

Right now, we can buy a portfolio of “investment grade” corporate bonds, which pays around an 8% p.a. yield. These are companies that are considered very secure and where the fund manager has done a detailed analysis of the risk of lending them money.

Alternatively, we can take a bit more risk by lending money to financial institutions. One of the funds in our portfolio has an estimated yield of around 11% p.a., with its top holdings being building societies like Nationwide and Coventry. (Source for yields: Premier Miton & TwentyFour).

Many banks and building societies are beneficiaries of rising interest rates. Mortgage rates tend to go up a lot quicker than savings rates, as we have all experienced.

Of course, in an economic downturn, more of these mortgages or other loans could turn bad. However, we think the potential return more than compensates for this increased risk and most such institutions have plenty of capital to absorb bad loans.

We have topped up all these different types of bond funds. In all these instances, the price of the bonds could move up or down sharply over the next few months. However, with enough patience we think we will see some very positive returns.

Finally, as mentioned in our bulletin from two weeks ago, we have also purchased a FTSE 100 Index tracker in most portfolios. An estimated 80% of the earnings of FTSE 100 companies come from outside the UK, according to a recent article in the Financial Times (9 September 2022).

The falling pound means that those earnings will have gone up in sterling terms.

How have we paid for all these investments?

Whilst all the major equity and bond markets has fallen in 2022, not everything in the portfolios have gone down.

For some time, we have preferred to hold “alternatives” such as absolute return funds to diversify risks and to hold less bonds than most similar portfolios. Some funds have done better than others, but in aggregate our alternatives portfolio has made a positive return this year (Source: FE Analytics).

To pay for the recent defined returns and bond purchases, we have sold some of these holdings. We have also sold some of the US dollar cash fund we held in portfolios and one of our property funds.

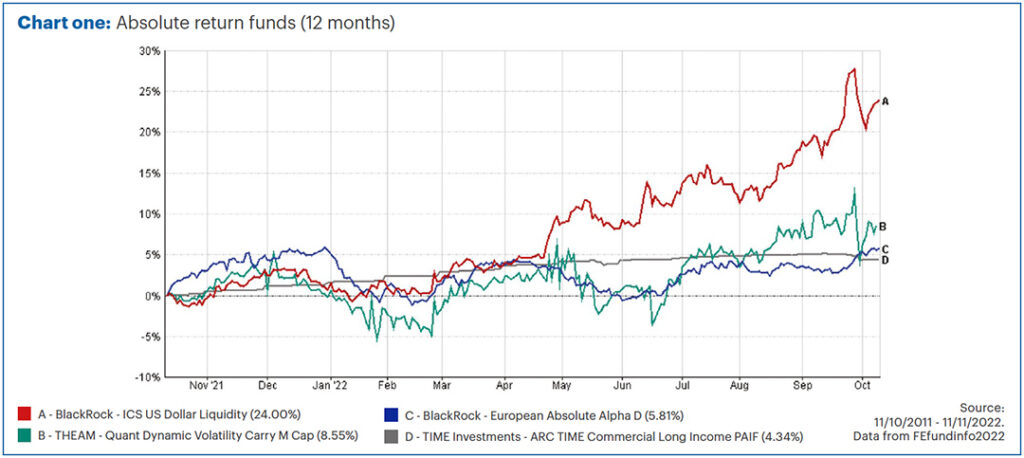

Chart one shows the returns of these four funds over the past 12 months – all have been sold or reduced recently to fund the above purchases. These funds have made gains of between 4% and 24% over the past year, offsetting some of the losses in the likes of equity and fixed interest.

These funds have done their jobs in the portfolios and now we want to switch to the defined returns and bond funds given the potential returns look so attractive.

The exact trades we have carried out differs from portfolio to portfolio, depending on the risk profile.

One other change we have also made in the portfolios is to reduce exposure to some of the smaller, more domestically focused UK companies in favour of larger, more internationally focused companies (such as the FTSE 100).

Unfortunately, we do believe the prospects for the UK economy have worsened. The rise in mortgage rates means people will have less money to spend on everything else. It has already led to the housing market grinding to a screeching halt and in all probability, will lead to a drop in house prices.

Despite this, some of these UK companies are very cheap and we think they are likely to rally strongly given enough time. We therefore retain some exposure to these company types, especially those with resilient cash flows and high dividend yields.

However, we think that the uncertainty around this has increased and there are other assets with attractive potential returns with greater visibility.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future. This blog is intended as an information piece and does not constitute a solicitation of investment advice. Written on 13 October 2022 and correct at the time of writing.

Lorem ipsum, dolor sit amet consectetur adipisicing elit. Vero eos temporibus nobis reiciendis nihil quaerat nisi architecto porro culpa amet nam delectus ad quod, doloribus, voluptas pariatur alias perspiciatis commodi. Expedita quis necessitatibus cupiditate labore magni iure odio libero culpa est assumenda vero inventore asperiores ex saepe cum consequatur iste.

Dignissimos minus. Odit debitis adipisci fugit sed quia fugiat ut.