Why it’s time to start buying bonds

Is Manchester Airport going bust?

We don’t think so.

Indeed, with all the charges for parking and dropping off, the airport seems like a licence to print money.

The business itself is owned mainly by local authorities and Manchester City Council which are equally unlikely to disappear overnight.

Against that background, then, why are the bonds issued by Manchester Airport so cheap?

The bonds were originally sold at £1 each in 2019 and have now fallen to 50p. Put it another way, the bondholders are paid interest every year and so if you buy it now, the bond pays 7.7% (12th October): –

Source: Refinitiv – September 2022

Bond prices, like prices of most assets, go down when nobody wants them. Investors sell and the price falls, simple demand and supply.

Bond investors will sell mainly if they are worried about two things; whether they will receive the interest on their bond and whether they will get their original capital (principal) back when the bond ends. These events are only really in danger of happening if the company is in financial trouble.

But Manchester Airport isn’t in financial trouble, so what’s going on?

Bonds in general have been sold down ferociously this year. Inflation, as we know, has pushed up all year and is currently standing at 10.1%.

Yes, this is above the 7.7% that the Airport bond pays, but we expect inflation to fall to around 4-5% in a year’s time, whereas the bond will continue paying 7.7% until 2044 if we buy it now. Looking at it another way, 7.7% is way above any interest rate you will receive on a deposit bank account.

What about buying government bonds instead? Surely, they are much safer?

Well, they are a bit safer, and the yield is good, but they pay a yield of 4%, nearly half of the Airport bonds pay.

The fact is the fall in many bond prices has resulted in a lot more investment opportunities now they offer better value. The bond market has literally thrown some babies out with the bathwater in the precipitous falls this year.

Degrees of safety

Manchester Airport is not alone.

If you are wary of the travel industry, how about education?

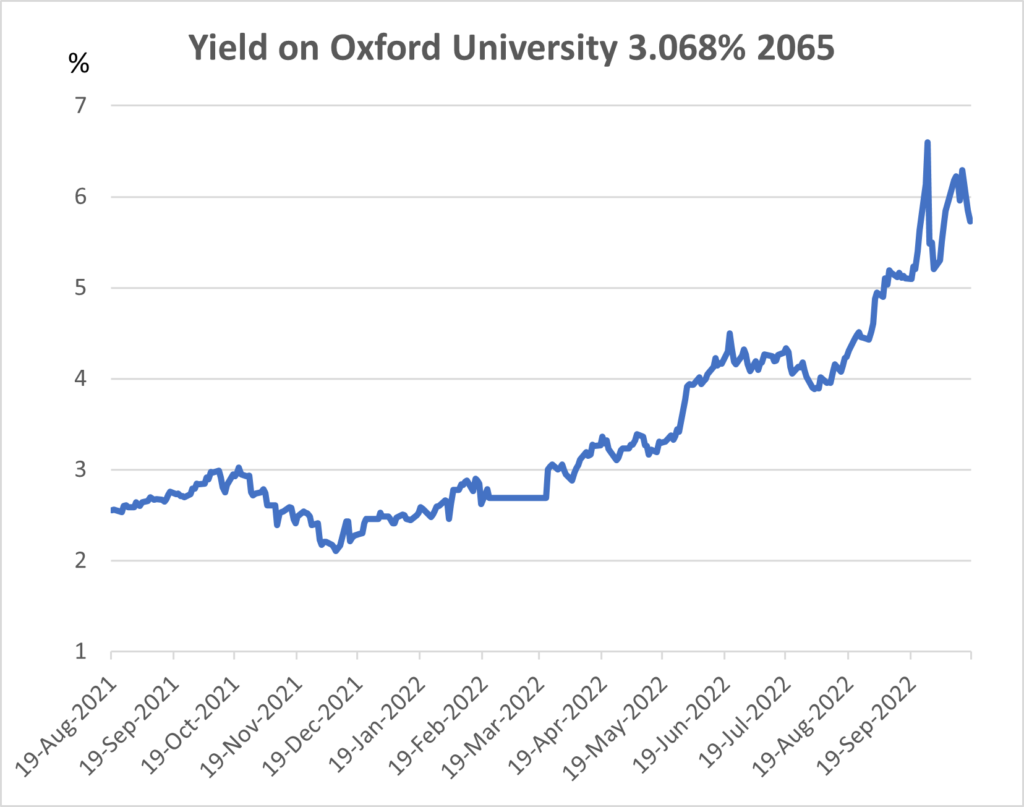

Oxford University has been around since 1096 and has endowments of around £6.4bn. The University’s bond, like the Airport bond, fell to 50p recently, giving a very safe 6.6% yield at that price: –

Source: Refinitiv – September 2022

This goes to show that you don’t need to stick your neck out to get attractive returns from secure bond issuers at these levels.

Yes, you could get more adventurous – bonds in less secure companies offer yields in the double-digit percentages. However, coming into a recession, these bonds will be buffeted by the volatility and uncertainly (we will be looking out for when the coast is clear to start buying here too) but in the meantime, the safe stuff offers great returns today.

In the last few weeks, we have increased our holdings in bond funds given the value now on offer.

We remain cautious of highly speculative bonds as we potentially enter a recession but well-financed companies with relatively secure earnings now offer bonds with yields of over 7% and we would expect both interest rates and inflation to be well below this level in the coming years.

Past performance is for illustrative purposes only and cannot be guaranteed to apply in the future.

This blog is intended as an information piece and does not constitute a solicitation of investment advice.

Sed unde aut pariatur ex veniam, nam consequatur nesciunt voluptatibus itaque ea? Quisquam sint nam illum hic labore, aliquid odit eos autem aspernatur quam. Molestiae, ipsa cupiditate beatae dolor atque corrupti enim fuga delectus temporibus voluptas ex. Nihil voluptas perferendis magni aspernatur.

Accusantium illum repudiandae obcaecati quam, dolorem officia hic qui dolores fugiat nam tenetur eligendi minima fugit repellat sequi inventore.