The IFSL Equilibrium Portfolio Funds & factsheets

IFSL has established five funds corresponding to our five model portfolios which Equilibrium clients can invest in.

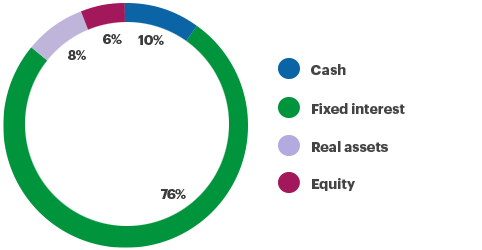

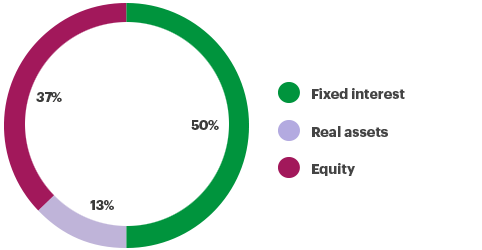

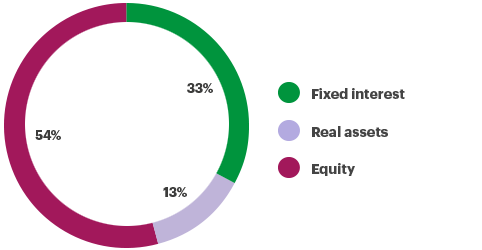

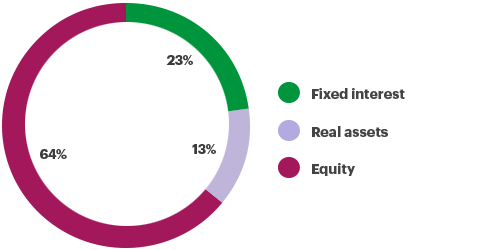

The charts below show the long term strategic allocations to which each fund is managed. This is the allocation we would target should all asset classes be (in our opinion) fair value. In reality, we adapt the asset allocation of each fund to market conditions and therefore the amounts held in each asset class can vary. Please refer to the fund factsheets for the up to date positioning.

The fund has a target of 3% over bank base rate and aims for a positive return over rolling three year periods. It will hold no more than 25% in equity based investments.

The fund will typically have less than half the portfolio in equities and related instruments but this can vary depending on the manager’s outlook at the time.

The fund will typically have around half the portfolio in equities and related instruments but this can vary depending on the manager’s outlook at the time.

The fund will typically have more than half the portfolio in equities and related instruments but this can vary depending on the manager’s outlook at the time.

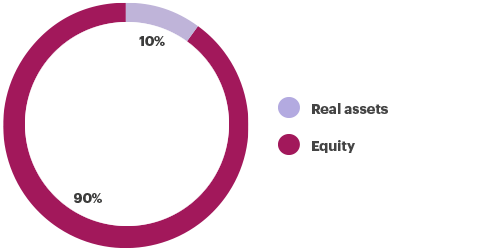

The fund will typically have more than three quarters the portfolio in equities and related instruments but this can vary depending on the manager’s outlook at the time.

This portfolio seeks to deliver a total return above that of the FTSE AIM Index while mitigating Inheritance Tax.

What are the benefits?

Some of the benefits of investing in a ‘fund of funds’ are listed below:

- Improved market timing

- Access to discounts on the funds we use

- Identical performance for every client in the same fund

- Tax efficiency improvements

- Fund charges are collected from within the fund

- Access to more specialist investment options

- Reduced out of market period on fund switches

- Improved risk control when placing trades

- Simpler reporting

- Oversight of our investment process

- More efficient management of contributions and withdrawals

To view previous fact sheets please click to view the archive here.

Please click here to access all IFSL literature including our full Key Investor Information Document & Fund Prospectus.

The value of your investments can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested. Whilst equity investments carry potential for attractive returns over the longer term, the volatility of these returns can also be relatively high